Securities¶

This component provides information on the balance of securities held in the current brokerage account. Such securities are divided by type and presented in the following tabs:

- securities quoted on the cash market;

- derivative instruments quoted on the derivatives market.

The summary fields located at the top of this component present the total value of all securities held in the brokerage account, including the value of long option positions (if any are held):

Total value of securities - amount representing the market value of securities held in the account, determined at the last trade price. This is the total of the products of multiplying the quantities of individual securities by their last market prices;

Incl. value of long option positions - amount representing the market value of open long option positions held in the account, determined at the last settlement price.

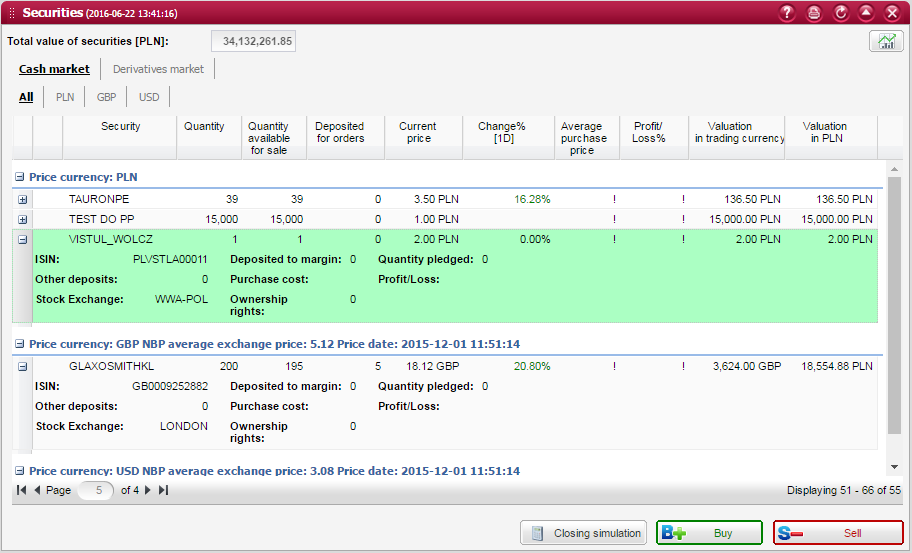

Cash market¶

This tab presents securities quoted on the cash market that are held in your brokerage account.

If there are securities listed with foreigh currency on the account - there will be additional tabs available.

First tab will allow to get a list of all securities, having securities grouped by currency. Further tabs will allow to get a list of securities listed in certain currency (separately for every tab).

These securities are displayed in a list containing the following columns:

Columns

Security - trade name of the security;

Quantity - total quantity of securities held in the account (including those that have been deposited, pledged, etc.)

Quantity available for sale - quantity of securities held in the primary securities account. This field informs you how many securities can be put up for sale;

Deposited for orders - quantity of securities that are held in the deposited securities account. This field informs you how many securities have been deposited for sell orders;

Current price - last price at which the security was traded during the current session. If you check this information during off-trading hours, this column will present the last known price of the security;

Change % - percentage change of the security`s current price to its previous close. This column features a special option % change over period (available by right-clicking on the column) which launches and additional submenu containing the following values: 1D (default), 7D, 14D, 1M, 3M, 6M, 1Y, 3Y, 5Y, ALL. Percentage change won’t be presented for bonds;

Average purchase price - average price paid to buy one security, weighted by the quantity of purchased securities. Commissions charged on purchases of the security are not taken into account. If it is not possible to calculate this value, the field will display “N/A” (no data available);

Profit/Loss % - percentage difference between the current market value of selected securities and their purchase cost. This value does not include commissions to be charged on disposal of securities;

Valuation (in trading cureency) - amount of market value for securities, calulated using last trade price in trading currency.

Valuation (in w PLN) - amount of market value of securities, calculated using last trade price valuated by average NBP exchange price for the currency of the trade;

You can expand the selected position line by clicking on the + button. The expanded section contains additional information fields:

ISIN - 12-character code representing the international securities identification number;

Deposited to margin - quantity of securities that are held in the maintenance margin account. This field informs you how many securities have been deposited to maintenance margin on open positions as well as on active orders for derivatives;

Quantity pledged - quantity of securities held in the pledged securities account. This field informs you how many securities have been deposited as pledges;

Other deposits - quantity of securities that are held in the account of securities deposited for other purposes. This field informs you how many securities have been deposited for other operations, such as transfers of securities, exercise of rights from securities,…;

Profit/Loss - amount of difference between the current market value of given securities and their purchase cost. This value does not include commissions to be charged on disposal of securities;

Purchase cost - amount paid for the selected securities. It presents the value of held securities at their average purchase price;

Stock Exchange - 3-letter code of the stock exchange where a given security is quoted;

Market for orders - designation of the orders market where a given security is quoted;

Ownership rights - quantity of securities recorded in the ownership rights clearing account maintained with the National Depository for Securities. This field informs you how many securities you actually own in accordance with the trade settlement rules applied by the NDS. As a result, if some of your security purchases have not yet been cleared by the NDS, the quantity presented in this column will be smaller than the quantity of securities held in your brokerage account. On the other hand, if some of your security disposals have not yet been cleared, the quantity presented in this column will be bigger than the quantity of securities held in your brokerage account. Purchases/disposals of securities quoted on the cash market are usually cleared in three business days (shares, allotment rights and certificates) or in two business days (bonds, warrants and pre-emptive rights) after your trade has been executed.

Interest on bonds - amount of current interest on bonds as at the settlement date (T+2). This field is presented for bond positions only;

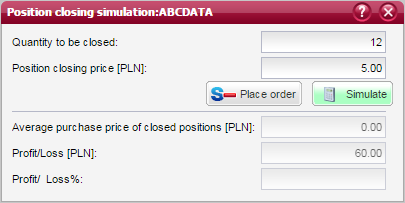

Closing simulation¶

Window presents profit/loss simulation for selected position.

Closing quantity - quantity to be used in simulation. Quantity musn’t be greater than quantity available.

Closing price - price to be used in simulation for closing of the position.

Simulation can be executed by pressing Simulate button.

Avg. purchase price for closing securities - simulated average price for closing positions - for 1 security in trading currency.

Profit/Loss - value of profit or loss simulated in trading currency. Value doesn’t include comission.

Profit/Loss% - value of profit or loss simulated in percents. Value doesn’t include comission.

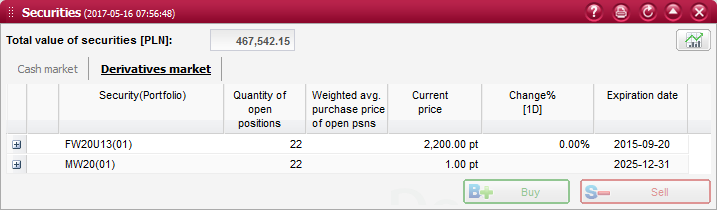

Derivatives market¶

This tab presents open derivative positions that are held in your brokerage account and quoted on the derivatives market.

These derivative positions are displayed in a list containing the following columns:

Columns

Security - trade name of the security;

Quantity of open positions - quantity of positions open in a given derivative instrument held in the account. A positive value indicates a long position, negative - a short position;

Average position opening price - average price paid to open one position, weighted by the quantity of traded securities;

Current price - last price at which the security was traded during the current session. If you check this information during off-trading hours, this column will present the last known price of the derivative instrument;

Change % - percentage change of the security`s current price to its previous close. This column features a special option % change over period (available by right-clicking on the column) which launches and additional submenu containing the following values: 1D (default), 7D, 14D, 1M, 3M, 6M, 1Y, 3Y, 5Y, ALL.

Expiration date - date of termination of trading in a given security. It indicates the date when the security`s final settlement price will be determined - the third Friday of the expiration month. If no session is held on such day, then it will be the last trading day before the third Friday of the expiration month.

You can expand the selected position line by clicking on the + button. The expanded section contains additional information fields:

ISIN - 12-character code representing the international securities identification number;

Multiplier - multiplier applied to calculate the position`s settlement value;

Contract value - value of the derivative contract calculated as the product of the multiplier and the security`s last settlement price;