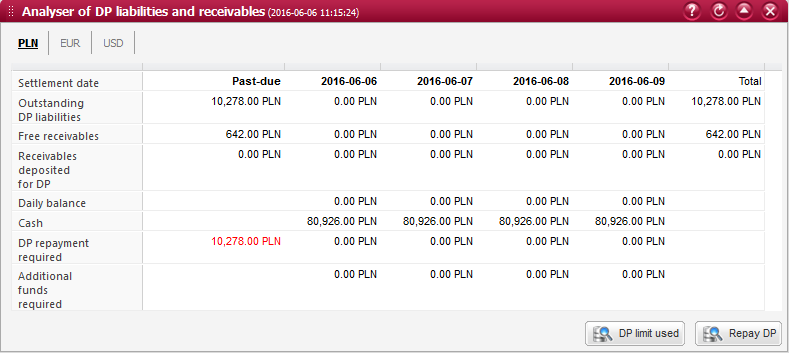

Analysis of DP liabilities and receivables¶

This window provides information on the value of liabilities resulting from trades executed for deferred payment (DP) orders, as well as on receivables generated from the sale of securities.

The objective of such report is to determine the amount of DP liabilities falling due on a given day because their repayment may require transferring additional funds into your brokerage account. Whereas, receivables generated from the sale of securities are presented in order to show what portion of DP liabilities can be paid off with unused receivables.

If there are many currencies on the account - analysis for each currency are available in separate tabs.

This report is generated for the current day and for the next three trading days.

When a reported value is marked in red colour, this means that the balance of DP liabilities is higher than the amount of funds available for repayment.

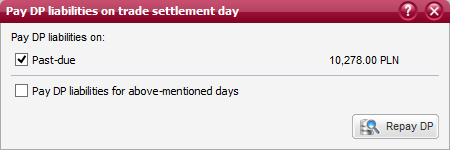

If the DP repayment required shows a value marked in red colour, then you should repay the deferred amount by clicking on the Repay DP button. If the repayment is required on the current day, it should be made immediately because past-due liabilities will be subject to penalty interest.

Lines

Settlement date - date of the settlement of receivables and liabilities

Outstanding DP liabilities - amount of liabilities resulting from deferred payments to be settled on a given day;

Free receivables - amount of free receivables (available for use) to be settled on a given day;

Receivables deposited for DP - amount of receivables that have been deposited for repayment of DP liabilities (which cannot be paid off with cash) to be settled on a given day;

Daily balance - balance of DP liabilities and receivables on a given settlement day. It represents the difference between the Amount of free receivables and the Amount of outstanding DP liabilities, increased by the Amount of receivables deposited for DP all to be settled on a given day. When marked in red colour, this value informs that the amount of liabilities falling due on a given day exceeds the amount of receivables to be settled on that day;

Cash - for the current day, it is the amount of cash held in the primary account of your brokerage account. For the next reported days, it represents the forecast balance of the primary cash account, including any inflows (from the settlement of receivables) and outflows (for the repayment of DP liabilities) on top of the prior daily balance;

DP repayment required - amount of DP liabilities required to be repaid on a given day (which are not offset by receivables to be settled on that day);

Additional funds required - amount of additional funds that need to be paid into your brokerage account on a given day in order to enable the repayment of DP liabilities on that day (this is reported when DP liabilities are not offset by receivables to be settled on that day).