Rights from securities¶

This component provides information on the rights arising from securities held in the brokerage account, which confer certain entitlements or for which certain operations have been planned.

Individual types of rights are presented in the following separate tabs:

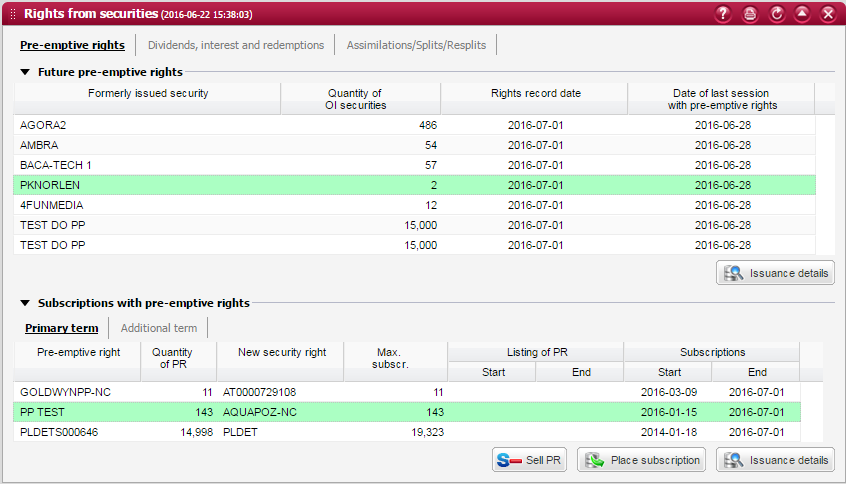

Pre-emptive rights¶

This tab presents information about your rights arising from the acquired securities for which an issuance with pre-emptive rights is offered.

Depending on the term and status of such issuance, your pre-emptive rights can refer to future events, involving the grant of single pre-emptive rights, or to subscriptions available under any currently offered issuance.

If the record date of a pre-emptive right for a security held in your brokerage account (for which a pre-emptive rights issuance has been declared by the issuer) has been set to the current or later date, relevant information will be presented in the Future pre-emptive rights section.

If on the pre-emptive right record date you hold a security (for which a pre-emptive rights issuance has been announced), then a new instrument designated as “pre-emptive right” should appear in your brokerage account at the end of that day.

Pre-emptive rights can be exercised by subscribing newly issued shares in the primary term in accordance with the issuer`s resolution on increasing the share capital and issuance of new shares. Such information will be displayed in the Subscriptions with pre-emptive rights section, under the Primary term tab.

If on the pre-emptive right record date you hold a security (for which a pre-emptive rights issuance has been announced), then you will be also able to subscribe newly issued shares in the additional term in accordance with the issuer`s resolution on increasing the share capital and issuance of new shares. Such information will be displayed in the Subscriptions with pre-emptive rights section, under the Additional term tab.

Future pre-emptive rights¶

This section presents information about future events, involving the grant of single pre-emptive rights, if the record date of a pre-emptive right for a security held in your brokerage account (for which a pre-emptive rights issuance has been declared by the issuer) has been set to the current or later date.

Such information will be displayed in a list containing the following columns:

Columns

Formerly issued security - trade name of the security already issued under the Former Issuance;

Quantity of formerly issued securities - quantity of securities of the Former Issuance held in the brokerage account. This field informs how many single pre-emptive rights will be granted;

Rights record date - date when pre-emptive rights will be granted in accordance with the issuer`s resolution on increasing the share capital and issuance of new shares.

Date of last session with pre-emptive rights - date of the last trading session when you need to have the security ownership rights in your brokerage account in order to be eligible for pre-emptive rights;

Subscriptions with pre-emptive rights - primary term¶

This section presents information about your entitlement to subscribe newly issued shares in the primary term in accordance with the issuer`s resolution on increasing the share capital and issuance of new shares, as a result of holding single pre-emptive rights.

Such information will be displayed in a list containing the following columns:

Columns

Pre-emptive right - trade name of the single pre-emptive right;

Quantity of PR - quantity of single pre-emptive rights held in the brokerage account;

Newly issued security - trade name of the security offered under the New Issuance;

Max. subscription - maximum quantity of newly issued securities that can be subscribed in the primary term in accordance with the issuer`s resolution on increasing the share capital and issuance of new shares, quantity of single pre-emptive rights held, and the required ratio of pre-emptive rights to purchase newly issued securities.

Listing of PR (Start) - first day of listing of single pre-emptive rights on the stock exchange;

Listing of PR (End) - last day of listing of single pre-emptive rights on the stock exchange;

Subscriptions (Start) - first day of registration of subscriptions for New Issuance shares in the primary term;

Subscriptions (End) - last day of registration of subscriptions for New Issuance shares in the primary term;

Subscriptions with pre-emptive rights - additional term¶

This section presents information about your entitlement to subscribe newly issued shares in the additional term in accordance with the issuer`s resolution on increasing the share capital and issuance of new shares, as a result of holding any securities of the Former Issuance in your brokerage account on the pre-emptive right record date.

Such information will be displayed in a list containing the following columns:

Columns

Pre-emptive right - trade name of the single pre-emptive right;

Newly issued security - trade name of the security offered under the New Issuance;

Max. subscription - maximum quantity of newly issued securities that can be subscribed in the additional term in accordance with the issuer`s resolution on increasing the share capital and issuance of new shares.

Listing of PR (Start) - first day of listing of single pre-emptive rights on the stock exchange;

Listing of PR (End) - last day of listing of single pre-emptive rights on the stock exchange;

Subscriptions (Start) - first day of registration of subscriptions for New Issuance shares in the additional term;

Subscriptions (End) - last day of registration of subscriptions for New Issuance shares in the additional term;

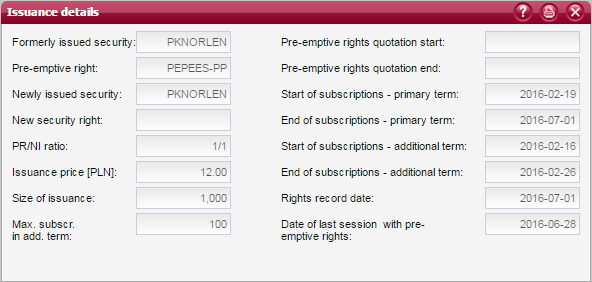

Issuance details¶

This section presents information about the selected public issuance of securities with pre-emptive rights.

List fields

Formerly issued security - trade name of the security already issued under the Former Issuance;

Pre-emptive right - trade name of the single pre-emptive right;

Newly issued security - trade name of the security offered under the New Issuance;

New security right - trade name of the right to the newly issued security;

PR/NI ratio - ratio for the allotment of newly issued securities, equalling the quantity of single pre-emptive rights divided by the quantity of newly issued securities;

Issuance price - price at which one security of the New Issuance is sold;

Size of issuance - quantity of securities offered under the New Issuance;

Max. subscription in additional term - maximum quantity of newly issued securities that can be subscribed in the additional term in accordance with the issuer`s resolution on increasing the share capital and issuance of new shares.

Start of PR listing - first day of listing of single pre-emptive rights on the stock exchange;

End of PR listing - last day of listing of single pre-emptive rights on the stock exchange;

Start of subscriptions in primary term - first day of registration of subscriptions for New Issuance shares in the primary term;

End of subscriptions in primary term - last day of registration of subscriptions for New Issuance shares in the primary term;

Start of subscriptions in additional term - first day of registration of subscriptions for New Issuance shares in the additional term;

End of subscriptions in additional term - last day of registration of subscriptions for New Issuance shares in the additional term;

Rights record date - date when pre-emptive rights will be granted in accordance with the issuer`s resolution on increasing the share capital and issuance of new shares.

Date of last session with pre-emptive rights - date of the last trading session when you need to have the security ownership rights in your brokerage account in order to be eligible for pre-emptive rights;

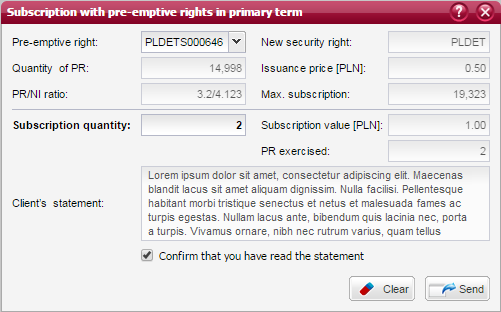

Subscription in primary term¶

This window contains the form for placing a subscription for newly issued security rights in the primary term.

In order to make a valid subscription, you will need to enter the quantity of newly issued security rights that you want to subscribe. Such subscribed quantity cannot result in the exercise of a larger quantity of pre-emptive rights than actually held in the account (PR exercised =< Quantity of PR).

In order to activate the Send button, you need to read the Client statement and confirm that you have read and understood it by checking the box located below the statement.

Form fields

Pre-emptive right - trade name of the single pre-emptive right;

Quantity of PR - quantity of single pre-emptive rights held;

New security right - trade name of the right to the newly issued security (which is de facto subscribed);

PR/NI ratio - ratio for the allotment of newly issued securities, equalling the quantity of single pre-emptive rights divided by the quantity of newly issued securities;

Issuance price - price at which one security of the New Issuance is sold;

Max. subscription - maximum quantity of newly issued securities that can be subscribed in the primary term;

Subscribed quantity - editable field for entering the quantity of newly issued securities that you want to subscribe in the primary term;

Subscription value - value of your subscription calculated by multiplying the subscribed quantity by the issuance price;

PR exercised - quantity of single pre-emptive rights that will be exercised upon placing a subscription for the specified quantity of newly issued securities;

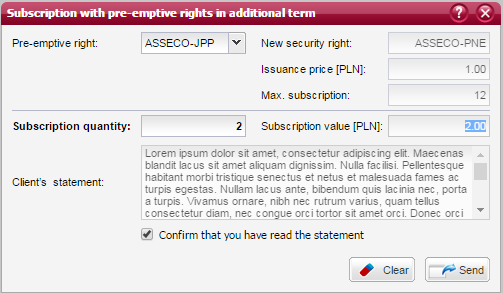

Subscription in additional term¶

This window contains the form for placing a subscription for newly issued security rights in the additional term.

In order to make a valid subscription, you will need to enter the quantity of newly issued security rights that you want to subscribe.

In order to activate the Send button, you need to read the Client statement and confirm that you have read and understood it by checking the box located below the statement.

Form fields

Pre-emptive right - trade name of the single pre-emptive right;

New security right - trade name of the right to the newly issued security (which is de facto subscribed);

Issuance price - price at which one security of the New Issuance is sold;

Max. subscription - maximum quantity of newly issued securities that can be subscribed in the additional term;

Subscribed quantity - editable field for entering the quantity of newly issued securities that you want to subscribe in the primary term;

Subscription value - value of your subscription calculated by multiplying the subscribed quantity by the issuance price;

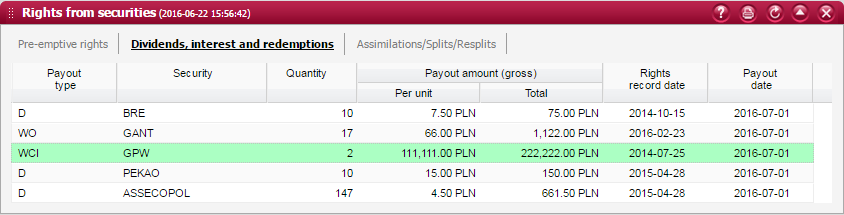

Dividends, interest and redemptions¶

This tab presents information about benefits incidental to holding securities, including payments of dividends on shares or interest on bonds, as well as redemptions of bonds or investment certificates.

Such information will be displayed in a list containing the following columns:

Columns

Payout type - clear determination of the type of benefit;

Security - trade name of the security eligible for the payout;

Quantity - quantity of securities held in the brokerage account, which are eligible for the payout;

Net payout amount (per unit) - amount to be paid out per one security held in the brokerage account, which is eligible for the payout. This amount does not include income tax to be charged on such payout;

Net payout amount (total) - amount to be paid out for all securities held in the brokerage account, which are eligible for the payout. This amount does not include income tax to be charged on such payout;

Rights record date - date determining when payout rights will be granted for individual securities;

Payout date - date of making the payout for eligible securities;

Note

Payment will no longer be displayed on the scheduled withdrawal date, unless it is actually withdrawn or closed (in this situation the payment will be visible until the end of the planned payout date). If the payment is delayed in relation to the planned payment date then it will be displayed until it is completed or it is fully closed.

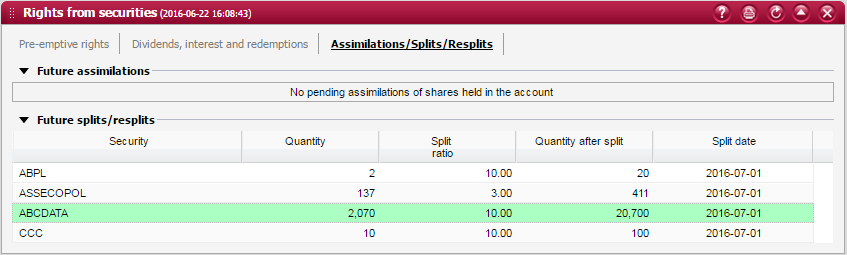

Assimilations / Splits / Resplits¶

This tab presents information about any assimilation, split or resplit operations that have been planned for securities held in your brokerage account.

Such operations are presented in the following separate sections:

Future assimilations¶

Assimilation is an operation whereby two securities with different codes are incorporated into one and the same security.

This presents information about any future assimilations that have been planned for securities held in your brokerage account. Such information will be presented until the assimilation operation is completed.

Planned operations are displayed in a list containing the following columns:

Columns

Assimilated security - trade name of the security to be assimilated;

Quantity - quantity of securities held in the brokerage account, which are to be assimilated;

Security after assimilation - trade name of the security following the assimilation operation;

Assimilation date - date when the assimilation operation is performed;

Future splits/resplits¶

A split is an operation whereby the par value on shares is decreased, while maintaining the existing amount of the company`s share capital. Whereas, a resplit is a reverse split operation whereby the par value on shares is increased, while maintaining the existing amount of the company`s share capital.

This section presents information about any future split or resplit operations that have been planned for securities held in your brokerage account.

Such information will be presented until the split/resplit operation is completed.

Planned split/resplit operations are displayed in a list containing the following columns:

Columns

Security - trade name of the security subject to the split/resplit operation;

Quantity - quantity of securities held in the brokerage account, which are subject to the split/resplit operation;

Split ratio - ratio to be applied for dividing/consolidating securities in the split/resplit operation;

Quantity after split - quantity of securities held in the brokerage account after completion of the split/resplit operation;

Split date - date when the split/resplit operation is performed;