Finances¶

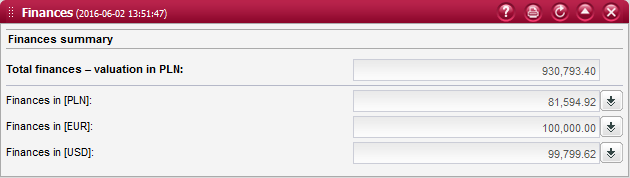

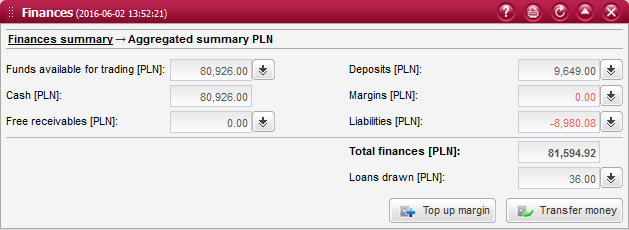

This component provides information on the balance of funds held in the current brokerage account.

If the account finances are in system currency and in foreign currency - there will be finances aggregated summary presented in the ‘Finances’ block, having financial aggregation for every currency. In addition, there will be presented total finances valuation in system currency, which is a sum of the valuations of the individual financial accounts for each currency (using NBP average exchange price).

Pressing the button located next to each financial aggregation for every currency - corresponding screen will appear with finances summary for chosen currency.

The amounts of funds held in the brokerage account are presented in separate fields in order to differentiate between various groups of funds:

Individual fields (except for Cash) are provided with detailed summaries which can be displayed by clicking on the buttons located beside these fields. Upon clicking on such button, the appropriate detailed summary will be presented in the same window, whereas the window header will show the navigation panel informing you which detailed summary is currently displayed.

Return to the main window containing the aggregated summary is possible by clicking on the Aggregated summary header in the window`s navigation panel.

The Total finances field presents the sum of all funds held in the account. This total does not include funds disclosed in the amount of loan drawn.

This window also contains the buttons intended for making money transfers:

- sending orders to transfer money

- to a bank account

- to another brokerage account

- sending orders to top up the maintenance margin account upon a margin call

Money transfers¶

This window presents the form for registration of a money transfer. The following two types of money transfers can be ordered:

- transfer to a bank account

- transfer to a brokerage account

You can switch between the individual types of money transfers by choosing the required tab.

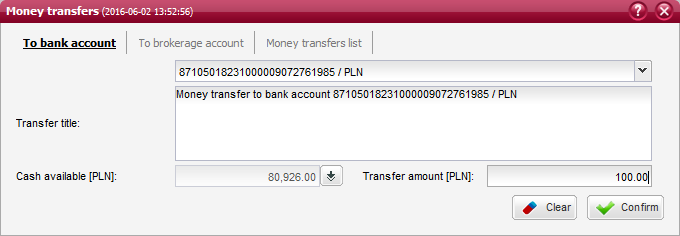

Money transfer to bank account¶

This window presents the form for registration of a money transfer to a bank account. Once all the required fields are filled, you can send the money transfer order by pressing the Confirm button.

Account no. - selection of one of the bank accounts registered for money transfers or one of the available brokerage accounts;

Transfer title - title of the money transfer, which should be an individual commentary made by the sending person;

Cash available - amount of funds available for transfers, which can be checked by pressing the button located beside this field;

Transfer amount - amount of money to be transferred. It should not be higher than the amount of funds available for transfers;

Note

A bank account for money transfers can be registered using the bank accounts management window.

Note

The amount of funds available for transfers depends primarily on the balance of cash held in the account, but also on the amounts of liabilities and loan collateral.

See also

Management of bank accounts for money transfers

Annexes to the brokerage account agreement can be reviewed in the account information component.

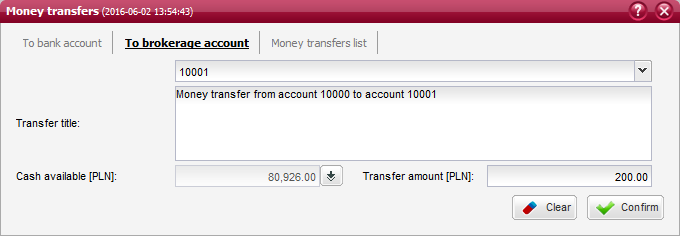

Money transfer to brokerage account¶

This window presents the form for registration of a money transfer to a brokerage account. Once all the required fields are filled, you can send the money transfer order by pressing the Confirm button.

Account no. - selection of one of the available brokerage accounts;

Transfer title - title of the money transfer, which should be an individual commentary made by the sending person;

Cash available - amount of funds available for transfers, which can be checked by pressing the button located beside this field;

Transfer amount - amount of money to be transferred. It should not be higher than the amount of funds available for transfers;

Note

You can only transfer money to brokerage accounts of which you are the owner, co-owner or plenipotentiary.

Note

The amount of funds available for transfers depends primarily on the balance of cash held in the account, but also on the amounts of liabilities and loan collateral.

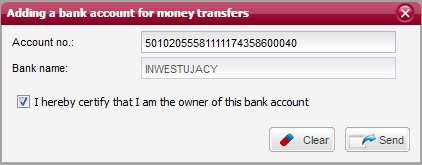

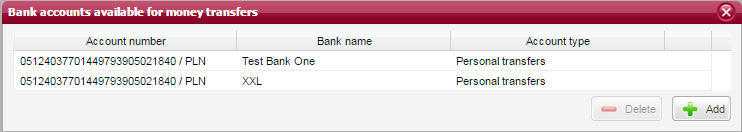

Bank accounts for money transfers¶

This window presents the list of bank accounts registered for money transfers. It is possible to add a new bank account or delete an existing one:

Columns

Account number - 26-digit number of the bank account for money transfers

Bank name - name of the bank account for money transfers

Account type - type of the bank account

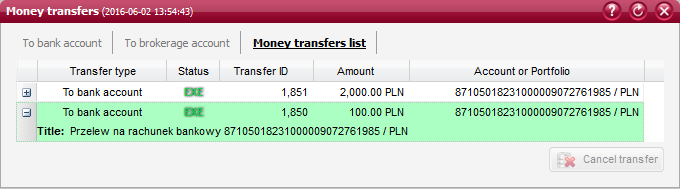

Cancellation of money transfers¶

This window presents the list of money transfer orders that have been registered from the active brokerage account. A selected money transfer order can be cancelled as long as its status is INS (Inserted).

The list includes the following columns:

Transfer type - designation of the money transfer type: To bank account, To brokerage account, Margin top-up;

Status - status of the transfer order in accordance with the legend (which is available after moving the mouse cursor over any status designation);

Transfer ID - ID number of the money transfer order;

Amount - amount of money to be transferred;

Account/Portfolio - number of the account or portfolio for which the money transfer has been registered;

You can expand the selected transfer line by clicking on the + button. The expanded section contains additional information:

Transfer title - title of the money transfer, which should be an individual commentary made by the sending person;

Note

Foreign transfers cannot be canceled.

You can only cancel such money transfers that are in the INS (Inserted) status. Once a money transfer is cancelled, its status will change to CNX (Cancelled) and the system will provide an appropriate notification.

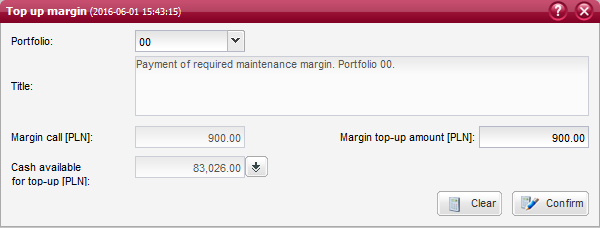

Margin top-up¶

This window presents the form for registration of an order to top up the maintenance margin account. Once all the required fields are filled, you can send the margin top-up order by pressing the Confirm button.

Portfolio - selection of one of the available portfolios for which you want to top up the margin account;

Title - permanent description of the margin top-up order;

Funds available for top-up - amount of funds that can be used for topping up the margin account, which can be checked by pressing the Check button located beside this field;

Transfer amount - amount of money to be transferred to the margin account. It should not be higher than the amount of funds available for transfers;

Note

The margin account must be topped up in case of a margin call, this is when the amount of margin deposited is smaller than the amount of maintenance margin required by the Brokerage House. Such a situation will be signalled with red colour in the Margins field.

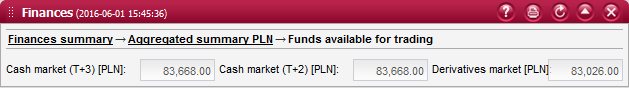

Funds available for trading¶

This window presents the amounts of funds available for placing orders in various markets, which are characterized by different trade settlement dates and rules of using receivables generated from the sale of securities.

Cash market (T+3) - amount of funds available for trading in securities that are quoted on the cash market and settled on T+3 date, e.g. shares, allotment rights;

Cash market (T+2) - amount of funds available for trading in securities that are quoted on the cash market and settled on T+2 date, e.g. bonds, pre-emptive rights (except for pre-emptive rights to securities traded on the New Connect market);

Derivatives market - amount of funds available for trading in securities that are quoted on the derivatives market, e.g. futures, options, index units.

Note

The amount of funds available for trading, as presented in the main window of the Finances component, corresponds to the value of Cash market (T+3).

Cash¶

The Cash field presents the amount of cash held in the primary account of the brokerage account.

Note

Cash represents the amount of liquid assets held in the brokerage account that are usually ready to be withdrawn from the account. This can be done except for situations in which a withdrawal would result in a default on the loan collateral, in such a case you will not be allowed to withdraw any cash.

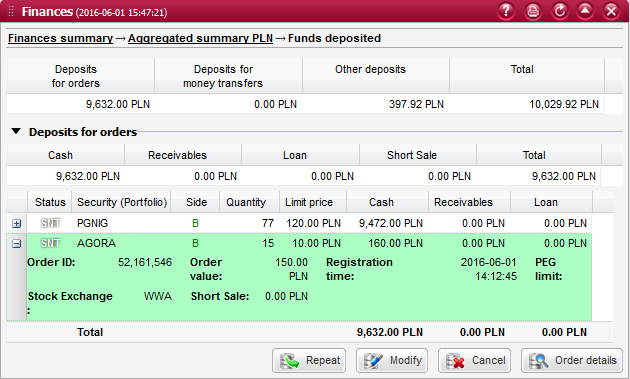

Deposits¶

This window presents a detailed summary of the amounts of funds that have been deposited. Such deposits of funds have been divided into:

- Deposits for orders

- Deposits for money transfers

- Other deposits

Note

Deposited funds cannot be used for any other purpose until being released from the deposit.

Deposits for orders¶

This field presents the amount of funds that have been deposited for the execution of brokerage orders. Displayed below is the list of orders that require depositing of funds, including their amounts.

The list of deposits for orders includes orders that require depositing of funds.

Above the list are displayed the fields summarizing the types of funds that have been deposited for orders:

Cash - amount of cash funds that have been deposited for all listed orders;

Loan - amount of funds obtained from loans that have been deposited for all listed orders;

Receivables - amount of receivables generated from the sale of securities that have been deposited for all listed orders;

Short sales - amount of proceeds from short sales that have been deposited for orders;

Total - total amount of funds that have been deposited for all listed orders.

The lower section contains the list of all brokerage orders that require depositing of funds. These brokerage orders are sorted chronologically, by the time of their registration in the system.

The columns present the following items:

Columns

Status - status of the brokerage order in accordance with the legend (which is available after moving the mouse cursor over any status designation).

Security - trade name of the security for which the order has been placed;

Order side - side of the order: B - buy or S - sell;

Limit price - limit price stated on the order. Instead of the limit price, this field may provide a description of one of the price options (MO, MTL, MTLO);

Quantity - quantity of securities on the order;

Cash - amount of cash funds that have been deposited for the order;

Receivables - amount of receivables generated from the sale of securities that have been deposited for the order;

Loan - amount of funds obtained from loans that have been deposited for the order;

Short sales - amount of proceeds from short sales that have been deposited for the order;

You can expand the selected order line by clicking on the + button. The expanded section contains additional information fields:

Order ID - unique ID number of the brokerage order;

Registration time - exact time and date of the brokerage order registration in the system;

Order value - net value of the brokerage order, representing a hypothetical value of the order calculated by multiplying the quantity of securities by the limit price.

See also

Deposited receivables have been also described in the Receivables section.

Deposits for money transfers¶

This field presents the amount of funds that have been deposited for money transfers. No detailed list is provided for this field;

Other deposits¶

This field presents the amount of funds that have been deposited for other purposes. No detailed list is provided for this field;

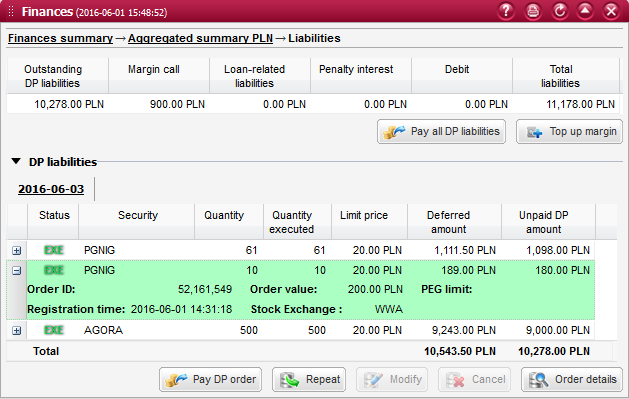

Liabilities¶

This window presents the summary of funds that are owed by the Client to the Brokerage House.

Note

Liabilities are deducted in the process of the brokerage account valuation, and therefore their amount is marked with minus in the aggregated summary. Whereas, in the detailed summary, liabilities are presented in positive values in order to facilitate their analysis.

The main section presents the values of different kinds of liabilities carried in the Client`s account towards the Brokerage House:

Outstanding DP liabilities - total amount of liabilities resulting from unpaid trades that have been executed for deferred payment orders. The constituents of this total amount are presented in the list of unpaid DP orders, which is located in the lower section of the window. The total of values displayed for all days in the Unpaid DP amount column represents the Outstanding DP liabilities;

Margin call - amount of the maintenance margin deficit that is required to be paid immediately. The margin account can be topped up by clicking on the Top up margin button, which is located below;

Loan-related liabilities - amount of liabilities resulting from the use of loans (interest, commissions, etc.). More information is available in the description provided to the field Loans drawn.

Penalty interest - amount of penalty interest arising from the missing payment of outstanding deferred payment liabilities.

Debit - negative balance in the primary account.

The details section presents the list of deferred payment liabilities arising from unpaid orders (placed with the DP option), grouped by the settlement day (i.e. days when such liabilities should be repaid). Individual groups are presented in separate tabs.

Unpaid brokerage orders are sorted chronologically, by the time of their registration in the system. The columns present the following items:

Columns

Status - status of the brokerage order in accordance with the legend (which is available after clicking on the ? button);

Security - trade name of the security for which the order has been placed;

Limit price - limit price stated on the order. Instead of the limit price, this field may provide a description of one of the price options (MO, MTL, MTLO);

Quantity - quantity of securities on the order;

Quantity executed - quantity of securities traded for the order;

Deferred amount - initial amount of deferred payment;

Unpaid DP amount - amount of outstanding deferred payment.

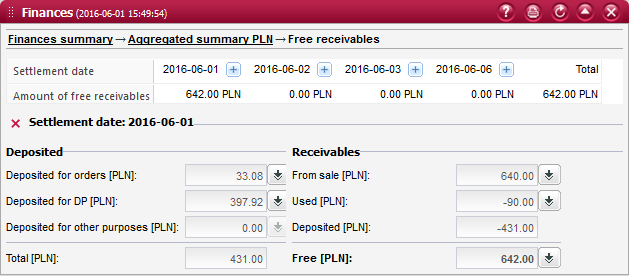

Free receivables¶

This window presents the amounts of unused receivables that have been generated from the sale of securities.

In the first section of this summary you can find the amounts of free (unused) receivables divided by settlement days, on which such receivables will be converted into cash. Upon pressing the button located beside any settlement date, the system will expand a section presenting the detailed amounts of receivables to be settled on the selected day.

Information presented in the details section of a given settlement day is divided into the following areas:

Deposited:

- Deposited for orders - total value of orders that require depositing of receivables from a given day

- Deposited for DP - total value of DP orders that require depositing of receivables from a given day

- Deposited for other purposes - total value of other operations that require depositing of receivables from a given day

- Total - total amount of all deposited receivables

Free:

- From sale - total amount of receivables generated from sell orders

- Used - used portion of receivables generated from sell orders

- Deposited - total amount of deposited receivables (equivalent to the Total value presented in the adjacent group of fields)

- Free - unused portion of receivables generated from sell orders

Note

By clicking on the buttons located beside these fields, you can display a window presenting the details of orders and operations that constituted the given value.

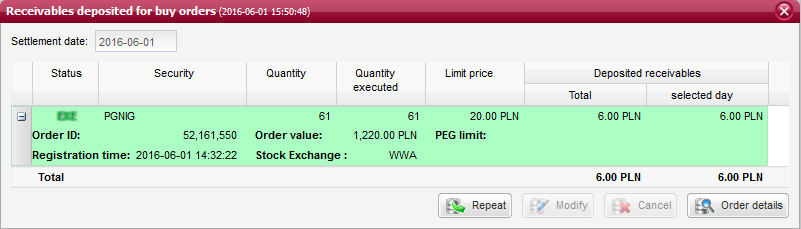

Deposited for orders¶

This field presents the amount of receivables deposited for buy orders, which are falling due on the selected settlement day. By clicking on the button located beside this field, you will launch a window listing the orders that require depositing of receivables.

The brokerage orders that require depositing of receivables are sorted chronologically, by the time of their registration in the system. The columns present the following items:

Columns

Status - status of the brokerage order in accordance with the legend (which is available after clicking on the ? button);

Security - trade name of the security for which the order has been placed;

Limit price - limit price stated on the order. Instead of the limit price, this field may provide a description of one of the price options (MO, MTL, MTLO);

Quantity - quantity of securities on the order;

Quantity executed - quantity of securities traded for the order;

Deposited receivables - total - amount of receivables deposited for the order, which are falling due on all settlement days;

Deposited receivables - selected day - amount of receivables deposited for the order, which are falling due on the selected settlement day;

You can expand the selected order line by clicking on the + button. The expanded section contains additional information fields:

Order ID - unique ID number of the brokerage order;

Registration time - exact time and date of the brokerage order registration in the system;

Order value - net value of the brokerage order, representing a hypothetical value of the order calculated by multiplying the quantity of securities by the limit price;

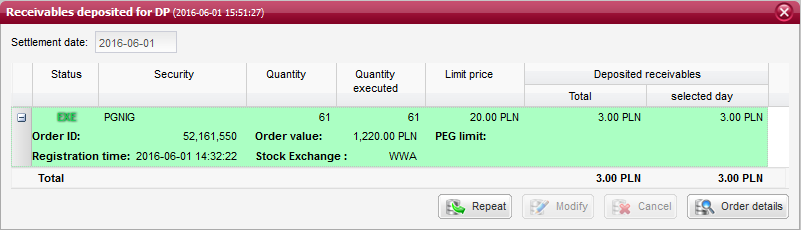

Deposited for DP¶

This field presents the amount of receivables deposited for unpaid deferred payment (DP) orders, which are falling due on the selected settlement day. By clicking on the button located beside this field, you will launch a window listing the unpaid DP orders that require depositing of receivables.

The brokerage orders that require depositing of receivables are sorted chronologically, by the time of their registration in the system. The columns present the following items:

Columns

Status - status of the brokerage order in accordance with the legend (which is available after clicking on the ? button);

Security - trade name of the security for which the order has been placed;

Limit price - limit price stated on the order. Instead of the limit price, this field may provide a description of one of the price options (MO, MTL, MTLO);

Quantity - quantity of securities on the order;

Quantity executed - quantity of securities traded for the order;

Deposited receivables - total - amount of receivables deposited for the unpaid DP order, which are falling due on all settlement days;

Deposited receivables - selected day - amount of receivables deposited for the unpaid DP order, which are falling due on the selected settlement day;

You can expand the selected order line by clicking on the + button. The expanded section contains additional information fields:

Order ID - unique ID number of the brokerage order;

Registration time - exact time and date of the brokerage order registration in the system;

Order value - net value of the brokerage order, representing a hypothetical value of the order calculated by multiplying the quantity of securities by the limit price;

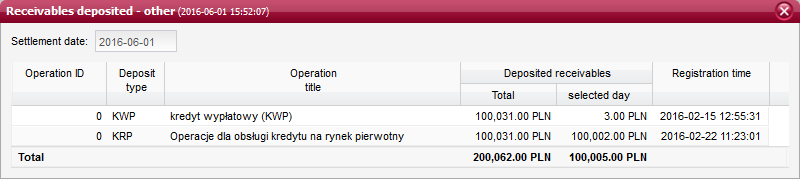

Deposited for other purposes¶

This field presents the amount of receivables deposited for other purposes (operations), which are falling due on the selected settlement day. By clicking on the button located beside this field, you will launch a window listing the operations that require depositing of receivables.

The operations that require depositing of receivables are sorted chronologically, by the time of their registration in the system. The columns present the following items:

Columns

Operation ID - status of the brokerage order in accordance with the legend (which is available after clicking on the ? button);

Type of deposit - symbol designating the type of the deposit;

Title - description of the operation that requires depositing of receivables;

Deposited receivables - total - amount of deposited receivables, which are falling due on all settlement days;

Deposited receivables - selected day - amount of deposited receivables, which are falling due on the selected settlement day;

Registration time - exact time and date of the operation registration in the system;

From sale¶

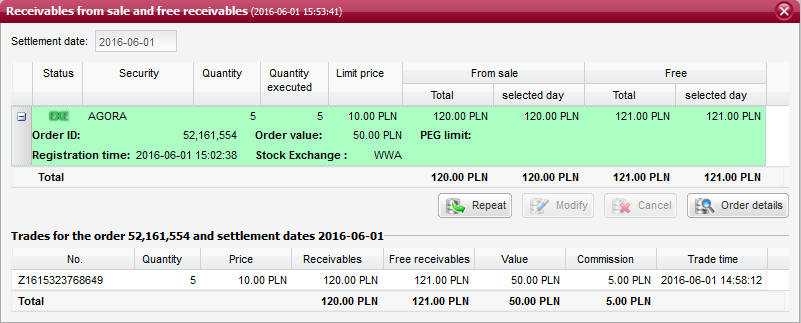

This field presents the amount of receivables generated from the sale of securities. The displayed amount represents the portion of generated receivables that are falling due on the selected settlement day. By clicking on the button located beside this field, you will launch a window listing the sell orders that have generated receivables.

These brokerage orders are sorted chronologically, by the time of their registration in the system. The columns present the following items:

Orders - columns

Status - status of the brokerage order in accordance with the legend (which is available after clicking on the ? button);

Security - trade name of the security for which the order has been placed;

Limit price - limit price stated on the order. Instead of the limit price, this field may provide a description of one of the price options (MO, MTL, MTLO);

Quantity - quantity of securities on the order;

Quantity executed - quantity of securities traded for the order;

From sale - total - amount of receivables generated from the sale of securities, which are falling due on all settlement days;

From sale - selected day - amount of receivables generated from the sale of securities, which are falling due on the selected settlement day;

Free - total - unused amount of receivables generated from the sale of securities, which are falling due on all settlement days;

Free - selected day - unused amount of receivables generated from the sale of securities, which are falling due on the selected settlement day;

You can expand the selected order line by clicking on the + button. The expanded section contains additional information fields:

Order ID - unique ID number of the brokerage order;

Registration time - exact time and date of the brokerage order registration in the system;

Order value - net value of the brokerage order, representing a hypothetical value of the order calculated by multiplying the quantity of securities by the limit price;

When you click on any of the listed orders, the list of trades executed for that order will be displayed below.

These trades are sorted chronologically, by the time of their registration in the system. The columns present the following items:

Trades executed for orders - columns

Trade ID - trade note number;

Quantity - quantity of securities traded;

Price - price at which securities were traded;

Receivables from sale - amount of receivables generated from the trade;

Free receivables - unused amount of receivables generated from the trade;

Value - net value of the trade calculated by multiplying the price by the quantity of securities traded;

Commission - amount of commission charged on the trade;

Execution time - date and time at which the trade was executed;

Used¶

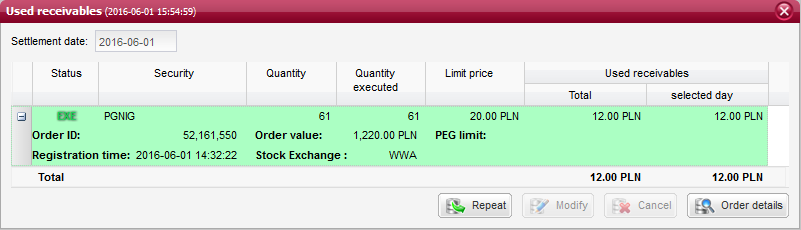

This field presents the used amount of receivables generated from the sale of securities, which are falling due on the selected settlement day. By clicking on the button located beside this field, you will launch a window presenting the execution of buy orders that were paid with receivables generated from the earlier sale of securities.

The brokerage orders that used (were paid with) receivables are sorted chronologically, by the time of their registration in the system. The columns present the following items:

Columns

Status - status of the brokerage order in accordance with the legend (which is available after clicking on the ? button);

Security - trade name of the security for which the order has been placed;

Limit price - limit price stated on the order. Instead of the limit price, this field may provide a description of one of the price options (MO, MTL, MTLO);

Quantity - quantity of securities on the order;

Quantity executed - quantity of securities traded for the order;

Receivables used - total - amount of receivables used for the order execution, which are falling due on all settlement days;

Receivables used - selected day - amount of receivables used for the order execution, which are falling due on the selected day;

You can expand the selected order line by clicking on the + button. The expanded section contains additional information fields:

Order ID - unique ID number of the brokerage order;

Registration time - exact time and date of the brokerage order registration in the system;

Order value - net value of the brokerage order, representing a hypothetical value of the order calculated by multiplying the quantity of securities by the limit price.

Free¶

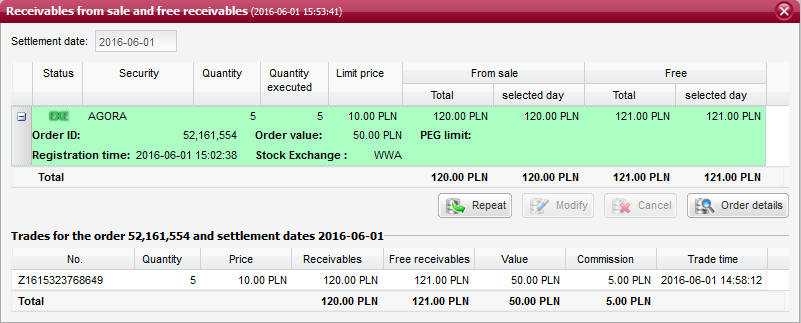

This field presents the unused amount of receivables generated from the sale of securities, which are falling due on the selected settlement day. By clicking on the button located beside this field, you will launch a window listing the sell orders that have generated receivables.

These brokerage orders are sorted chronologically, by the time of their registration in the system. The columns present the following items:

Orders - columns

Status - status of the brokerage order in accordance with the legend (which is available after clicking on the ? button);

Security - trade name of the security for which the order has been placed;

Limit price - limit price stated on the order. Instead of the limit price, this field may provide a description of one of the price options (MO, MTL, MTLO);

Quantity - quantity of securities on the order;

Quantity executed - quantity of securities traded for the order;

From sale - total - amount of receivables generated from the sale of securities, which are falling due on all settlement days;

From sale - selected day - amount of receivables generated from the sale of securities, which are falling due on the selected settlement day;

Free - total - unused amount of receivables generated from the sale of securities, which are falling due on all settlement days;

Free - selected day - unused amount of receivables generated from the sale of securities, which are falling due on the selected settlement day;

You can expand the selected order line by clicking on the + button. The expanded section contains additional information fields:

Order ID - unique ID number of the brokerage order;

Registration time - exact time and date of the brokerage order registration in the system;

Order value - net value of the brokerage order, representing a hypothetical value of the order calculated by multiplying the quantity of securities by the limit price;

When you click on any of the listed orders, the list of trades executed for that order will be displayed below.

These trades are sorted chronologically, by the time of their registration in the system. The columns present the following items:

Trades executed for orders - columns

Trade ID - trade identification number assigned by the stock exchange system (note number);

Quantity - quantity of securities traded;

Price - price at which securities were traded;

Receivables from sale - amount of receivables generated from the trade;

Free receivables - unused amount of receivables generated from the trade;

Value - net value of the trade calculated by multiplying the price by the quantity of securities traded;

Commission - amount of commission charged on the trade;

Execution time - date and time at which the trade was executed;

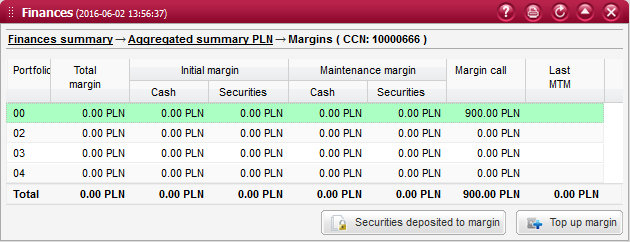

Margins¶

This window presents the sum of cash and value of securities that have been deposited to secure the settlement of open positions in derivatives (the so-called maintenance margin required by the National Depository for Securities) as well as for active orders for derivatives (the so-called initial margin).

Columns

Portfolio - 2-digit portfolio number used to identify an individual account within the derivatives account, assigned by the National Depository for Securities at the Client`s request;

Total margin - total amount of funds and value of securities deposited into the margin account;

Initial margin in cash - amount of funds provided to secure the payment of Client`s liabilities that might result from the execution of orders placed in the derivatives market;

Initial margin in securities - value of securities provided to secure the payment of Client`s liabilities that might result from the execution of orders placed in the derivatives market;

Maintenance margin in cash - amount of funds provided as a minimum security for the payment of Client`s liabilities resulting from derivative positions held in the account;

Maintenance margin in securities - value of securities provided as a minimum security for the payment of Client`s liabilities resulting from derivative positions held in the account;

Margin call - amount of the initial margin deficit that is required to be paid immediately;

Last mark-to-market - profit/loss on the portfolio from the last mark-to-market statement;

Note

If a margin call is issued for at least one of your portfolios, the amount of margin deficit presented in the Margins field of the aggregated summary will be marked in red colour.

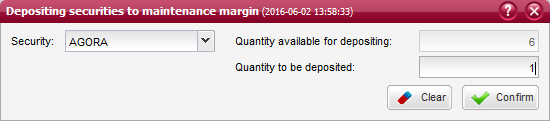

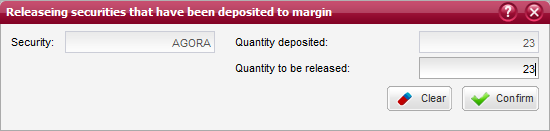

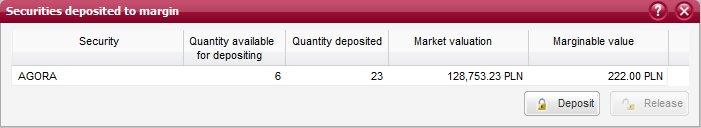

Securities deposited to margin¶

This window presents a list of securities that have been deposited into the margin account.

Security - trade name of the security that has been deposited into the margin account;

Quantity of marginable securities - the remaining quantity of securities that are available to be deposited into the margin account. This quantity also includes all the initial orders for depositing of securities;

Quantity deposited - quantity of securities that have been deposited into the margin account. This quantity only includes the deposits that have been confirmed by the National Depository for Securities;

Market value - valuation of securities deposited into the margin account representing their market value determined at the last trade price;

Marginable value - valuation of securities deposited into the margin account representing their value determined by the National Depository for Securities, i.e. calculated at prices adopted by the :NDS:;

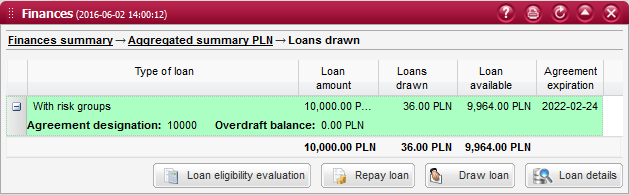

Loans drawn¶

This window presents the current amount of funds used (drawn) under loan agreements. In case more than one loan agreement is active, the total amount of funds drawn under all loan agreements will be displayed.

Loan designation - unique designation (number) of the loan agreement assigned by the institution granting the loan (creditor) - usually the bank with which the loan agreement has been signed;

Type of loan - identification of one of the types of loan agreements available in the Brokerage House (e.g. risk-weighted loan, specific purpose loan, overdraft facility, credit line, primary market loan, new issuance loan). In the case of new issuance (primary market) loans, this designation will also include the trade name of the security for which the loan is granted;

Amount of loan - amount of the loan granted by the creditor (bank), which is concurrently the maximum amount of funds that can be drawn under the loan agreement;

Amount drawn - currently drawn (used) amount of the loan;

Loan available - maximum instalment of the loan that can be drawn;

Agreement expiration - date of the loan agreement expiration, when the borrower will be obliged to repay the whole used amount of the loan to the creditor;

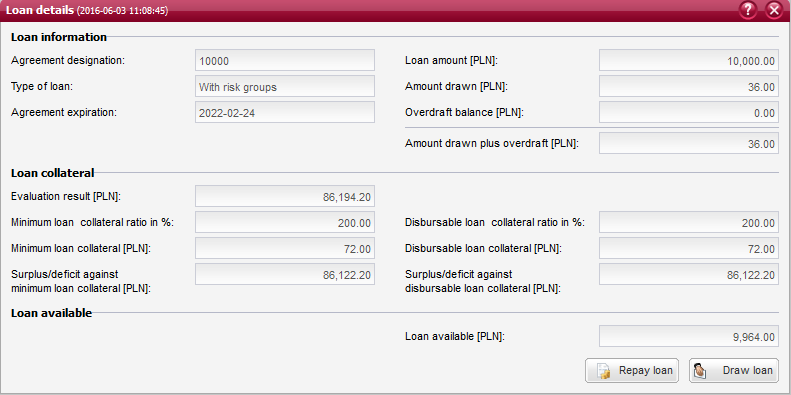

Loan details¶

This window presents details of the selected loan, including basic loan information, liabilities under the loan, loan-related deposits, account valuation for loan purposes, loan collateral, as well as the available amount of loan:

Loan designation - unique designation (number) of the loan agreement assigned by the institution granting the loan (creditor) - usually the bank with which the loan agreement has been signed;

Type of loan - identification of one of the types of loan agreements available in the Brokerage House (e.g. risk-weighted loan, specific purpose loan, overdraft facility, credit line, primary market loan, new issuance loan). In the case of new issuance (primary market) loans, this designation will also include the trade name of the security for which the loan is granted;

Agreement expiration - date of the loan agreement expiration, when the borrower will be obliged to repay the whole used amount of the loan to the creditor;

Amount of loan - amount of the loan granted by the creditor (bank), which is concurrently the maximum amount of funds that can be drawn under the loan agreement;

Amount drawn - currently drawn (used) amount of the loan;

Valuation of collateral - actual account valuation serving as loan collateral;

Minimum loan collateral ratio - ratio determined in the agreement;

Minimum loan collateral - required minimum level of the account valuation;

Surplus/deficit against minimum loan collateral - difference between the actual account valuation and the minimum loan collateral;

Disbursable loan collateral ratio - ratio determined in the agreement;

Disbursable loan collateral - required level of the account valuation in order to enable cash withdrawals;

Surplus/deficit against disbursable loan collateral - difference between the actual account valuation and the disbursable loan collateral;

Available amount of loan (max. instalment) - maximum instalment of loan available to be drawn;

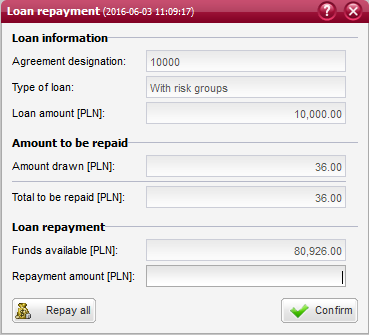

Loan repayment¶

This window contains the form for repayment of a selected loan. In this form, you will need to specify the demanded amount of loan repayment, which cannot be higher than the total amount of loan to be repaid or the total amount of loan drawn, as presented in the fields above. Once an adequate repayment amount is entered, you can send your order by pressing the Confirm button.

Loan designation - unique designation (number) of the loan agreement assigned by the institution granting the loan (creditor) - usually the bank with which the loan agreement has been signed;

Type of loan - identification of one of the types of loan agreements available in the Brokerage House (e.g. risk-weighted loan, specific purpose loan, overdraft facility, credit line, primary market loan, new issuance loan). In the case of new issuance (primary market) loans, this designation will also include the trade name of the security for which the loan is granted;

Amount of loan - amount of the loan granted by the creditor (bank), which is concurrently the maximum amount of funds that can be drawn under the loan agreement;

Amount drawn - currently drawn (used) amount of the loan;

Total to be repaid - total amount of loan drawn and loan-related liabilities;

Funds available - amount of cash funds available in the account, which can be used for loan repayment;

Repayment amount - demanded amount of loan repayment;

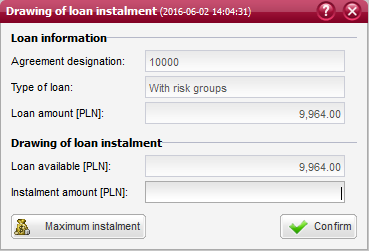

Drawing of loan instalment¶

This window contains the form for drawing an instalment of a selected loan. In this form, you will need to specify the demanded amount of loan instalment, which cannot be higher than the maximum available amount of loan, as presented in the field above. Once an adequate instalment amount is entered, you can send your order by pressing the Confirm button.

Loan designation - unique designation (number) of the loan agreement assigned by the institution granting the loan (creditor) - usually the bank with which the loan agreement has been signed;

Type of loan - identification of one of the types of loan agreements available in the Brokerage House (e.g. risk-weighted loan, specific purpose loan, overdraft facility, credit line, primary market loan, new issuance loan). In the case of new issuance (primary market) loans, this designation will also include the trade name of the security for which the loan is granted;

Amount of loan - amount of the loan granted by the creditor (bank), which is concurrently the maximum amount of funds that can be drawn under the loan agreement;

Available amount of loan (max. instalment) - maximum instalment of loan available to be drawn;

Instalment amount - demanded amount of loan instalment to be drawn in the active brokerage account;

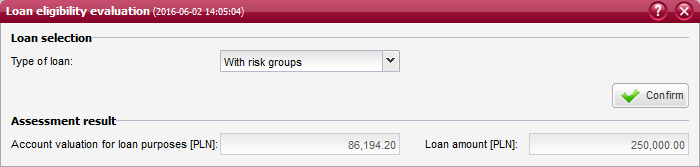

Loan eligibility evaluation¶

This window contains the form where you can request to evaluate your eligibility for a selected type of loan. Once such enquiry is sent, you will need to wait a while for the evaluation result to be presented in the fields located below.

Type of loan - identification of one of the types of loan agreements available in the Brokerage House (e.g. risk-weighted loan, specific purpose loan, overdraft facility, credit line, primary market loan, new issuance loan).

Amount of loan - amount of loan that can be obtained depending on the current valuation of your account. This amount also determines the maximum amount of funds that can be drawn under the loan agreement;

Account valuation for loan purposes - actual account valuation serving as collateral for the selected loan;