New order¶

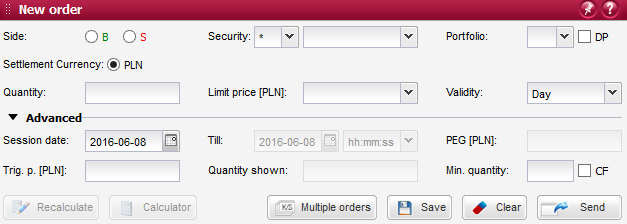

This component is launched by displaying the lower functional panel, containing the brokerage order form as well as the monitor of notifications and messages.

The brokerage order form allows for registering orders as well as carrying out other order-related functions (including the calculation of order values, saving of orders into user-definable baskets).

These functions are accessible through the new order form and the buttons located underneath the form.

The main functionality of this form is to send your orders to the market.

Furthermore, you can recalculate the order values in accordance with the entered attributes or the balance of your brokerage account. The order recalculation can be performed in the two modes: quick and advanced. Detailed information about this function is provided in the section describing both the calculators.

You can also save your defined order into a basket and send it to the market at a later time. This can be done by pressing the Save button after your order has been defined.

This form features a special window, allowing you to register and send multiple orders to the market in one time. In order to do so, press the Multiple orders button.

You can also unpin the new order form from your main workspace. After pressing the pin icon, the order form will be detached from the lower functional panel and placed in a separate browser window. In such a case, in place of the order form, the system will display the notifications monitor (which will be moved from its regular position within the monitor of notifications and messages).

Entering of order attributes and sending of orders¶

The form allows you to define the basic and advanced attributes of your order, and then send it to the market.

The order definition task should be started from the basic attributes section. If you want to define additional attributes of an order, you will need to expand the advanced attributes section, by clicking on the expand/collapse icon located on the left side of the Advanced section header.

Once you have entered all the required attributes of your order, you can send it to the market by clicking on the Send button. At this moment, the system will verify the inserted order attributes for being correct and complete in accordance with the stock exchange requirements, which will include checking:

- name or code of the security;

- side of the order (buy or sell);

- limit price (which must be determined with appropriate accuracy) or placing a no-limit order;

- quantity of securities to be traded;

- order validity date

- order placement date

Following a successful verification, your order will be registered and sent to the market.

If the option to confirm orders before their placement has been enabled in the system personalization settings, you will be additionally asked to confirm your order before being sent to the stock exchange.

Once your order is sent to the market, the system will display a window confirming the registration of your order, which will contain all the order attributes as well as the exact date and time of sending the order.

Basic attributes¶

This section enables entering and editing of basic order attributes, which are necessary to place an order. All attributes presented in this section must be filled to comply with the trading rules.

First, you need to select the order side, then the security for which you want to send an order (the list of available securities may be limited depending on the selected order side). Once these attributes are determined, some of other attributes will be filled automatically (e.g. limit price or quantity).

Side - radio-button selection of the order side: Buy or Sell;

Security – selection of the security is performed in two steps. In the first step you can select the group of securities from a drop-down field. The available groups shall be limited by your brokerage account rights (e.g. if you have not signed any annex for trading in derivatives, the derivatives group will not be available). This field is by default is set to Selected, if you have defined the list of selected securities (which can be edited in the window of system personalization settings). If you have not defined any selected securities, this field will be set to All, meaning that selectable securities will not be filtered by groups. The second step involves choosing the security from another drop-down field. The list of available securities will be limited depending on the group of securities indicated in the first step as well as on the securities held in the brokerage account. If you chose to register a Sell order, you will be able to enter only those securities which are available for sale (it does not apply to derivatives). Furthermore, this field features an autocomplete mechanism that filters out the available securities while you type in additional characters. Then you can use the keyboard arrow keys to select the desired security from the suggested list;

Portfolio - selection of the portfolio number from a drop-down list of active portfolios for derivatives. This attribute will be available only for securities quoted on the derivatives market. The portfolio with the lowest number will be chosen by default, unless you determine another default portfolio in the system personalization settings;

Settlement currency - currency in which the order will be executed.

DP - checking this field enables the use of deferred payment for the entered Buy order. This option shall be available subject to your brokerage account rights (e.g. if you have not signed any annex for deferred payments, the option will not be available). This field may, by default, be checked for Buy orders by choosing the relevant option in the system personalization settings;

Quantity - field for entering the quantity of securities for which the order shall be placed. For Sell orders this field is automatically filled with, and at the same time limited to, the quantity of the selected security held in the brokerage account (it does not apply to derivatives);

- Limit price - field for entering the limit price to be stated on the order which can be performed in two alternative modes. In the first mode, the limit price is filled automatically with the security`s last trade price if the relevant option has been chosen in the system personalization settings. In second mode, you can enter the limit price manually or select one of the available price options (MO, MTL, PEG). Individual price options have the following meanings:

- MO (Market Order) - order without a limit price, indicating an intention to buy/sell a specified quantity of securities at the best price currently obtainable in the market. In contrast to limit orders, the execution price of a market order cannot be controlled by the investor;

- MTL (Market To Limit) - similarly as a market order, a market-to-limit order is inserted into the trading system without a limit price and it may participate in the following session phases: Pre-Opening Call, Opening Auction, Continuous Trading. Such an order will be executed immediately at the current market price, i.e. at the best bid/ask price on the opposite side of the order book. If the order is not completely filled, the remaining quantity shall rest in the order book at the same limit price;

- PEG - order which is processed by the trading system and presented in the order book with a limit price that is equal to or better than the reference price. The limit price of a pegged order is continuously updated, tracking the security`s best bid or ask price. In the PEG limit field, you can define the minimum sell price (the so-called Floor) or the maximum buy price (the so-called Ceiling). When such a limit is reached, your pegged order will stop following the reference price;

- Validity - a drop-down list allowing for selection of one of the available order validity options: Day, GTD, GTC, GTT, IOC, FOK, VFA, or VFC. This field is by default set to the option that has been chosen in the system personalization settings. Individual validity options have the following meanings:

- Day - such order will be valid for one day, until the end of the session specified in the Session date field in the advanced attributes;

- GTD (Good Till Date) - such order will be valid from the session specified in the Session date field in the advanced attributes, till the date determined in the Till field in the advanced attributes;

- GTC (Good Till Cancelled) - such order will be valid till cancellation (or, if not cancelled, for 365 days from the order registration date);

- GTT (Good Till Time) - such order will be valid till the time determined in the Till field in the advanced attributes;

- IOC (Immediate Or Cancel) - such order may be filled in full or in part depending on market conditions, whereas any unfilled quantity shall be removed from the order book. If during the first trade only a part of the order is executed, the rest will be cancelled;

- FOK (Fill Or Kill) - such order must be filled completely and immediately after it is entered in the order book or, if impossible, the order shall be cancelled and removed from the order book;

- VFA (Valid For Auction) - such order shall be valid for the Opening Auction or Closing Auction only;

- VFC (Valid For Closing) - such order shall be valid for the Closing Auction only;

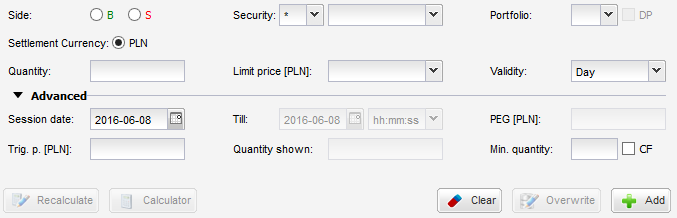

Advanced attributes¶

This section allows for entering and editing of additional order attributes:

Session date - field for entering the session date for which the order shall be placed. This field is by default set to the date of the current session (or the next session, if the order is placed during off-session hours);

Till - field for entering the session date till the end of which the order shall be valid, if the GTD option has been selected in the Validity field in the basic attributes. Alternatively, here you can also enter the order validity time, if the GTT option has been selected in the Validity field in the basic attributes;

Trigger price - field for determining an additional limit for the order (regardless of the limit type entered in the Limit price field). Such order shall be entered into the order book on condition the indicative matching price (IMP) or the last trade price during continuous trading reaches the trigger price. Setting this limit can be helpful in defining Stop Loss and Stop Limit orders;

CF - checking the Confirm Flag attribute will result upholding the order in the market, even if it exceeds the value limit, the quantity limit, or the static or dynamic trading curbs;

Quantity shown - field for entering the quantity of securities to be disclosed in the order book. This quantity must be smaller than the quantity of securities on the order, but it cannot be lower than 100. Setting this limit can be helpful in hiding large-volume orders;

Min. quantity - field for determining the minimum quantity of securities to be traded for the order in the market. If the specified minimum quantity cannot be filled for your order, it will be rejected by the trading system. If your order is not completely executed but only in the minimum quantity, its remaining portion shall rest in the order book, but then to be traded with no minimum quantity requirement;

PEG limit - field for determining a PEG limit for the order, this is the maximum/minimum limit price up to which the trading system will modify the order automatically. This is the so-called Ceiling for buy orders or Floor for sell orders;

Recalculation of order values¶

This form provides functions allowing to recalculate the values of orders in the following two modes: quick and advanced.

Note

Calculation in done in selected settlement currency.

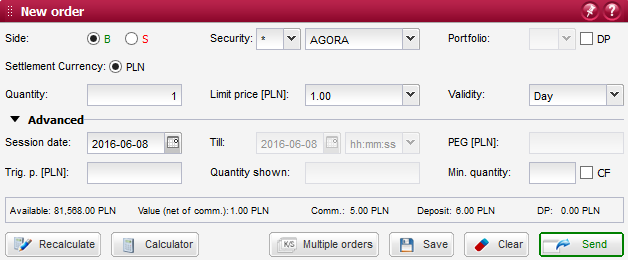

In the quick mode, the order values are recalculated after pressing the Recalculate button, which is located at the bottom of the new order form, and then presented in the expanded section of this window.

Whereas, in the advanced mode, recalculation of the order values is performed in a new window that can be launched by pressing the Calculator button located at the bottom of the new order form window. In this mode you can obtain more detailed information about the inserted order values, as compared with the quick mode.

Quick order recalculation¶

Once you have entered all the required attributes of your order and pressed the Recalculate button, the system will verify the inserted order attributes for being correct and complete in accordance with the stock exchange requirements, which will include checking:

- name or code of the security;

- side of the order (buy or sell);

- limit price (which must be determined with appropriate accuracy) or placing a no-limit order;

- quantity of securities to be traded;

Afterwards, an additional section will be expanded at the bottom of the window, which will present the calculation results in the following fields:

For securities quoted on the cash market

Available - depending on the order side:

- for Buy orders, this field will display the amount of funds available for placing orders in the market appropriate for the selected security;

- for Sell orders, this field will display the quantity of securities available for sale;

Value (net of commission) - order value calculated by multiplying the limit price by the quantity;

Commission - amount of commission payable (upon execution) if the order is placed;

Deposit - depending on the order side:

- for Buy orders, this field will display the amount of funds to be deposited if the order is placed. This amount should not be greater than the amount of funds available for trading, as presented in the Available field;

- for Sell orders, this field will display the quantity of securities to be deposited if the order is placed. This quantity should not be greater than the quantity of securities available for sale, as presented in the Available field;

DP - amount of deferred payment that you will be eligible for, if the order is placed with the DP option. It represents the maximum amount you will be obliged to pay under the deferred payment agreement, if the order is fully executed.

For securities quoted on the derivatives market

Amount available - amount of funds available for trading in the derivatives market (for the maintenance margin);

Margin change - amount of change in the maintenance margin for the indicated portfolio if the order is placed;

Deposit - amount of funds to be deposited into the margin account if the order is placed. This amount should not be greater than the amount of funds available for trading, as presented in the Available field;

Commission - amount of commission payable (upon execution) if the order is placed;

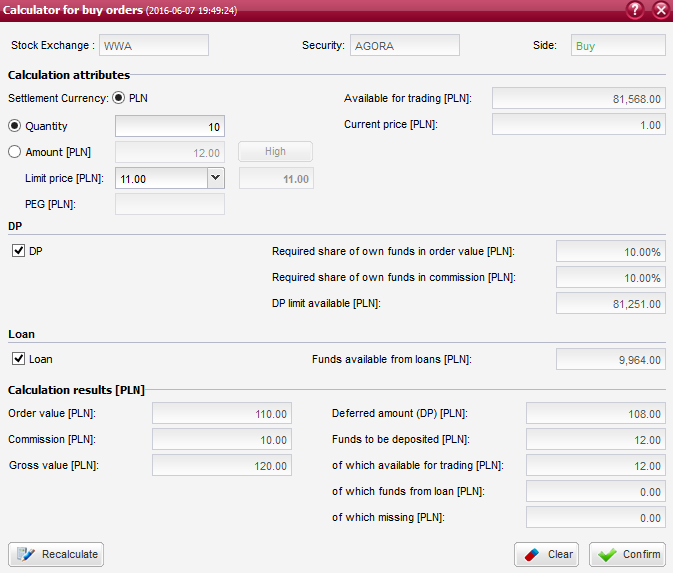

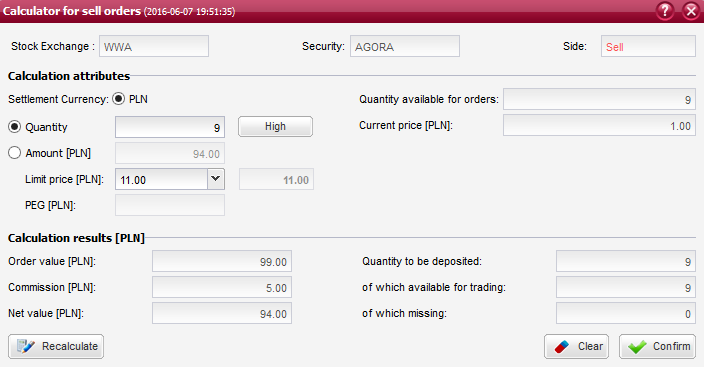

Advanced calculator for the cash market¶

Once you have entered all the required attributes of your order (Side and Security) and pressed the Calculator button, the system will display a new window with the advanced calculator.

Al the inserted order attributes will be transferred into the calculator. Now you can enter and edit the fields which are used in the order calculation process. This window also contains the order information fields. The fields are presented in the following sections:

Calculation attributes

Settlement currency - allows to set currency in which the order will be executed;

Amount - field for entering any amount that shall be used in the calculation. This field will by default display the amount of funds available for placing orders in the market appropriate for the selected security. You can restore this amount at any time, by clicking on the Max button located beside this field;

Quantity - field for entering the quantity of securities for which the order shall be placed. For Sell orders this field is automatically filled with, and at the same time limited to, the quantity of the selected security held in the brokerage account. You can restore this quantity at any time, by clicking on the Max button located beside this field;

Limit price - field for entering the limit price to be stated on the order which can be performed in two alternative modes. In the first mode, the limit price is filled automatically with the security`s last trade price if the relevant option has been chosen in the system personalization settings. In second mode, you can enter the limit price manually or select one of the available price options (MO, MTL or PEG). Individual price options have the following meanings:

MO (Market Order) - order without a limit price, indicating an intention to buy/sell a specified quantity of securities at the best price currently obtainable in the market. In contrast to limit orders, the execution price of a market order cannot be controlled by the investor;

MTL (Market To Limit) - similarly as a market order, a market-to-limit order is inserted into the trading system without a limit price and it may participate in the following session phases: Pre-Opening Call, Opening Auction, Continuous Trading. Such an order will be executed immediately at the current market price, i.e. at the best bid/ask price on the opposite side of the order book. If the order is not completely filled, the remaining quantity shall rest in the order book at the same limit price;

PEG - order which is processed by the trading system and presented in the order book with a limit price that is equal to or better than the reference price. The limit price of a pegged order is continuously updated, tracking the security`s best bid or ask price. In the PEG limit field, you can define the minimum sell price (the so-called Floor) or the maximum buy price (the so-called Ceiling). When such a limit is reached, your pegged order will stop following the reference price;

Displayed next to this filed is the Calculation price which is the limit price that will be applied in the calculation, if you have selected one of the MO, MTL or PEG options. Moreover, in the case of securities of the bonds market, this field will present the nominal value and interest of a bond as at the current day.

Funds available for trading - presented for Buy orders only. This field will display the amount of funds available for placing orders in the market appropriate for the selected security;

Quantity available for trading - presented for Sell orders only. This field will display the quantity of securities available for sale;

Price - current price of the security, for which the calculation has been launched. During off-session hours, this field will display the closing price of the last session;

Note

The Quantity and Amount values can be also recalculated, depending on which of these fields is “selected” during the calculation:

- if, between these two fields, the Amount is the last entered value, then this field will be selected and the system will perform an additional calculation of the optimal Quantity taking into account all other attributes, and insert the resulting value into the Quantity field;

- if, between these two fields, the Quantity is the last entered value, then this field will be selected and the system will perform an additional calculation of the optimal Amount taking into account all other attributes, and insert the resulting value into the Amount field;

- if no Limit price is entered when launching the recalculation function, then this field will be automatically filled with the MO option, hence the calculation will be based on the current trading curbs value as displayed in the adjacent Calculation price field;

- if neither the Quantity nor the Amount is entered, then the system will not be able to perform the calculation and will display the following message: “Please define quantity or amount”;

- upon completion of a Buy order calculation, the Amount will be filled with the value from the Deposit filed, regardless of the Amount presented when launching the recalculation function;

- upon completion of a Sell order calculation, the Amount will be filled with the value from the Net order value filed, regardless of the Amount presented when launching the recalculation function.

DP (presented only for Buy orders and securities eligible for deferred payment)

DP - checking this field enables the use of deferred payment for the entered Buy order. This option shall be available subject to your brokerage account rights (e.g. if you have not signed any annex for deferred payments, the option will not be available). This field may, by default, be checked for Buy orders by choosing the relevant option in the system personalization settings;

Required share of own funds in order value - required share of own funds in the order value, in accordance with your agreement for deferred payments;

Required share of own funds in commission - required share of own funds in the amount of commission, in accordance with your agreement for deferred payments;

DP limit available - maximum available amount of deferred payment, in accordance with your agreement for deferred payments. This field specifies the maximum amount that can be provided to your account;

Loan (presented only for Buy orders and securities eligible for crediting by the Brokerage House)

Loan - checking this field enables the use of loan funds for the entered Buy order. This option shall be available subject to your brokerage account rights (e.g. if you have not signed any loan agreement or your loan is not intended for the selected security, the option will not be available);

Funds available from loan - amount of loan available for purchasing the selected security;

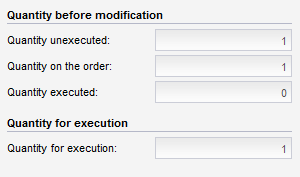

Quantity of securities before modification (presented for order modifications only)

Quantity executed - quantity of securities traded for the order before modification;

Quantity on the order - quantity of securities stated on the order (excluding any executed trades) before modification;

Quantity not executed - quantity of securities that are remaining to be traded for the order before modification;

Quantity for execution - quantity of securities representing the difference between the quantity entered in the Quantity field for calculation purposes and the Quantity executed for the order. This field specifies the quantity of securities remaining to be traded for the order when the modification is registered;

Once you have entered all the required attributes of your order and pressed the Recalculate button, the system will verify the inserted order attributes for being correct and complete, inclusive of the Quantity or Amount which are necessary for performing the calculation. If the Limit price field is left empty, it will be automatically filled with the MO option.

Calculation results

Order value - order value calculated by multiplying the limit price by the quantity, which is additionally increased (for Buy orders) or decreased (for Sell orders) by the amount of commission;

Commission - amount of commission payable (upon execution) if the order is registered;

Net value - order value calculated by multiplying the limit price by the quantity, net of commission;

Amount of deferred payment - available for Buy orders only. When you place this order, payment of this amount will be deferred. It represents the maximum amount you will be obliged to pay under the deferred payment agreement, if the order is fully executed. This amount is not included in the amount of funds to be deposited for the order;

Funds to be deposited - amount of funds to be deposited if the order is registered. The field called of which available for trading presents a portion of the deposit that can be provided from funds held in the account, which can be deposited for the entered order (this amount cannot be greater than the presented amount of Funds available for trading). However, if the amount of funds to be deposited is higher than the amount of funds available in the account, the missing portion of the required deposit will be presented in the field of which missing and marked in red colour. Whereas, a portion of the required deposit that can be provided from loan funds is presented in the field of which funds from loan (this amount cannot be greater than the presented amount of Funds available from loan to be used for this order);

Quantity to be deposited - quantity of securities to be deposited if the order is registered. The field called of which available for trading presents a portion of the deposit that can be provided from securities held in the account, which are available for sale. However, if the quantity of securities to be deposited is higher than the quantity of securities available for sale, the missing portion of the required deposit will be presented in the field of which missing and marked in red colour;

When you press the Confirm button, the system will close the advanced calculator window and take you back to the order registration form, retaining the order attributes inserted in the calculator form.

You can also delete all values entered in the calculator`s editable fields by pressing the Clear button.

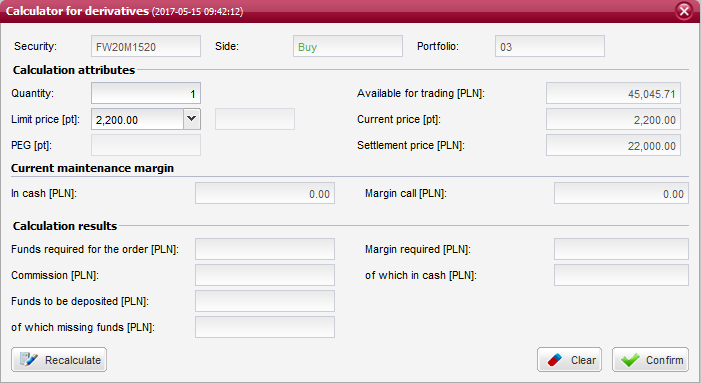

Advanced calculator for the derivatives market¶

Once you have entered all the required attributes of your order (Side, Security and Portfolio) and pressed the Calculator button, the system will display a new window with the advanced calculator.

Al the inserted order attributes will be transferred into the calculator. Now you can enter and edit the fields which are used in the order calculation process. This window also contains the order information fields. The fields are presented in the following sections:

Calculation attributes

Quantity - field for entering the quantity of securities for which the order shall be placed;

Limit price - field for entering the limit price to be stated on the order which can be performed in two alternative modes. In the first mode, the limit price is filled automatically with the security`s last trade price if the relevant option has been chosen in the system personalization settings. In second mode, you can enter the limit price manually or select one of the available price options (MO, MTL or PEG). Individual price options have the following meanings:

MO (Market Order) - order without a limit price, indicating an intention to buy/sell a specified quantity of securities at the best price currently obtainable in the market. In contrast to limit orders, the execution price of a market order cannot be controlled by the investor;

MTL (Market To Limit) - similarly as a market order, a market-to-limit order is inserted into the trading system without a limit price and it may participate in the following session phases: Pre-Opening Call, Opening Auction, Continuous Trading. Such an order will be executed immediately at the current market price, i.e. at the best bid/ask price on the opposite side of the order book. If the order is not completely filled, the remaining quantity shall rest in the order book at the same limit price;

PEG - order which is processed by the trading system and presented in the order book with a limit price that is equal to or better than the reference price. The limit price of a pegged order is continuously updated, tracking the security`s best bid or ask price. In the PEG limit field, you can define the minimum sell price (the so-called Floor) or the maximum buy price (the so-called Ceiling). When such a limit is reached, your pegged order will stop following the reference price;

Displayed next to this filed is the Calculation price which is the limit price that will be applied in the calculation, if you have selected one of the MO, MTL or PEG options;

Funds available for trading - amount of funds available for placing orders (that can be deposited to maintenance margin);

Val. of marginable securities - valuation of securities deposited into the margin account according to the rules of the National Depository for Securities;

Current price - current price of the security, for which the calculation has been launched. During off-session hours, this field will display the closing price of the last session;

Settlement price - settlement price of the selected security;

(Daily margin limit) Current - current amount of the daily maintenance margin;

(Daily margin limit) Maximum - maximum amount of the daily maintenance margin;

Current maintenance margin

(Current maintenance margin) In cash - amount of funds deposited into the margin account, for the given portfolio;

(Current maintenance margin) In securities - value of securities deposited into the margin account, for the given portfolio;

(Current maintenance margin) Margin call - amount of the maintenance margin deficit;

See also

More information on maintenance margins can be found in the Margins section.

Once you have entered all the required attributes of your order and pressed the Recalculate button, the system will verify the inserted order attributes for being correct and complete, inclusive of the Quantity or Amount which are necessary for performing the calculation. If the Limit price field is left empty, it will be automatically filled with the MO option.

Calculation results

Funds required for the order - total amount of the margin required and commission to be deposited if the order is registered;

Commission - amount of commission payable (upon execution) if the order is registered;

Funds to be deposited - amount of funds to be deposited if the order is registered. This amount should not be greater than the presented amount of Funds available for trading. However, if the amount of funds to be deposited is higher than the amount of funds available in the account, the missing portion of the required deposit will be presented in the field of which missing funds;

Margin required - amount of the maintenance margin required for the given portfolio if the order is registered. The field called of which in cash presents a portion of the required margin that can be provided from the cash account, whereas a portion that can be provided by marginable securities is presented in the field of which in securities;

When you press the Confirm button, the system will close the advanced calculator window and take you back to the order registration form, retaining the order attributes inserted in the calculator form.

You can also delete all values entered in the calculator`s editable fields by pressing the Clear button.

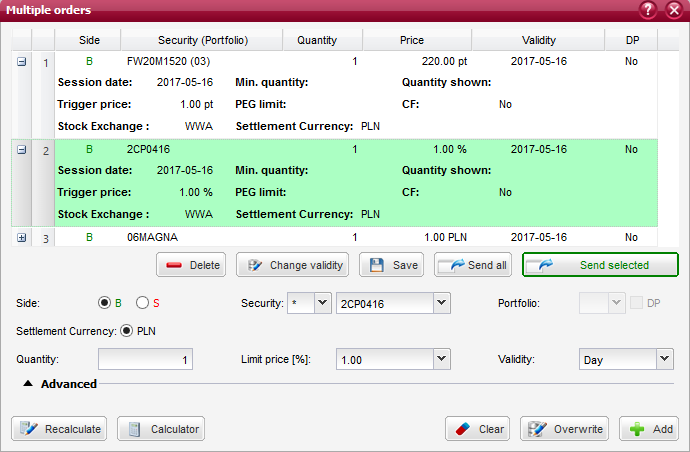

Multiple orders¶

The “Multiple orders” window allows you to register several orders into a temporary basket and then send such orders to the market. You can also create a new basket of orders based on the orders added to the temporary list (such orders can be also added into an existing basket as additional, new items).

The multiple orders window is comprised of two sections:

- temporary list of orders;

- form for editing the orders included in the temporary list.

See also

The functionality of the multiple orders window is very similar to the baskets of orders. The main difference is that in this window your orders are added into a temporary basket of orders, and not into a basket that has been already created. However, your temporary basket orders can be saved into an existing basket with the help of the Save function.

Contents of the temporary list of orders¶

Your orders should be first registered into a temporary basket before being sent to the stock exchange.

Orders included in your temporary basket are presented in the following columns:

Columns

Side - side of the order: Buy or Sell;

Security (Portfolio) - trade name of the security for which the order has been placed. The portfolio number applicable to the order is stated in the brackets (only for derivative market orders);

Quantity - quantity of securities on the order placed on the market. This quantity may be different from the quantity stated on the initial order if it was subject to a reduction (the field presents the quantity after reduction);

Limit price - limit price stated on the order;

Validity - date of the session till the end of which the order shall remain valid or another order validity option. This field may alternatively present the order validity time for GTT (Good Till Time) orders;

DP - indication whether the order has been placed with the deferred payment option (Yes or No);

You can expand the selected order line by clicking on the + button. The expanded section contains additional information fields:

Session date - indication of the session date;

Trigger price - price to trigger off the order. When this limit is reached, the order will appear in the order book;

PEG limit - PEG limit for the order determining the maximum/minimum limit price up to which the trading system will modify the order automatically. This is the so-called Ceiling for buy orders or Floor for sell orders;

Quantity shown - quantity of securities that are disclosed in the order book;

Min. quantity - minimum quantity of securities to be traded for the order in the market;

CF - Confirm Flag (Yes or No);

Stock exchange - market of the order.

Functions related to sending multiple orders to the market can be launched with the buttons described below:

Basket orders editing form¶

An order can be registered into the temporary basket by adding a newly defined order from the order editing form, which is located below the list of orders of your temporary basket.

Orders that have been saved in the temporary basket can be edited. When you select one of such orders, the attributes of that order will be displayed in the order editing form which is available below the list of orders.

The form for editing of a basket order contains identical fields as in the regular brokerage order form.

This form, however, features a different set of buttons: