Orders¶

This component provides information on orders that have been registered from the active brokerage account.

Note

Current orders represent orders which continue in validity (have not expired), this is when the validity date of an order is not earlier than the current date (or when no validity date is specified for an order such as GTC, IOC, FOK, VFC, VFA, GTT).

Hence, each current order has to satisfy one of the following conditions:

- an order has been registered on the current date (regardless of being already executed or still active);

- an order has been registered earlier than on the current date but is still active (its validity has not expired);

- an order has been registered earlier than on the current date and is not active in the current session, but will become active at a later time (a pending order).

Current orders have been divided into groups according to their execution status. These groups are presented in the form of tabs, serving as filters of orders. The following groups of current orders are distinguished:

All - this tab presents all the current orders

Active - this tab includes current orders that are either active in the current trading session or pending activation. Such orders can be modified or cancelled to the extent permitted by their specificity. Current orders may have the following statuses:

INS - Inserted

BKD - Booked

SNT - Sent

MKT - On market

PEX - Partially executed

DCN - During cancellation

DMO - During modification

Executed - this tab includes orders that are no longer active and their status cannot be changed (they have been already cancelled, rejected or fully executed). Executed orders may have the following statuses:

EXE - Executed

CLD - Closed

CNX - Cancelled

REJ - Rejected

Historical orders represent orders that have been placed from the active brokerage account during a selected period. Such orders are presented in the History tab, which is by default set to display the recent 7 days. In order to change this default time range and apply other filtering criteria, you need to expand the filter section by clicking on the Selection conditions.

List of orders¶

The list of orders includes the following columns:

Columns

Status - status of the order in accordance with the legend (which is available after moving the mouse cursor over any status designation). An order may have one of the following statuses:

INS - Inserted

BKD - Booked

SNT - Sent

MKT - On market

PEX - Partially executed

DCN - During cancellation

DMO - During modification

EXE - Executed

CLD - Closed

CNX - Cancelled

REJ - Rejected

Note

An order, regardless of its status, may be marked with the following additional symbols:

- - quantity on the order has been reduced (it is not equal to the quantity stated on the initial order)

! - the order has not been served properly by the stock exchange system and this error is described in the order details window

Order ID - unique ID number of the brokerage order;

Security (Portfolio) - trade name of the security for which the order has been placed. The portfolio number applicable to the order is stated in the brackets (only for derivative market orders);

Side - indication of the Buy or Sell side of the order;

Quantity - quantity of securities on the order placed on the market. This quantity may be different from the quantity stated on the initial order if it was subject to a reduction (the field presents the quantity after reduction);

Quantity executed - quantity of securities traded for the order;

Limit price - limit price stated on the order;

Validity - date of the session till the end of which the order shall remain valid or another order validity option. This field may alternatively present the order validity time for GTT (Good Till Time) orders;

You can expand the selected order line by clicking on the + button. The expanded section contains additional information fields:

Initial order ID - ID number of the initial order (instruction) to register a brokerage order;

Registration time - exact time and date of the brokerage order registration in the system;

Access channel - description of the access channel through which the order has been placed. The following access channels are available:

- CSP - order placed at the Customer Service Point

- Telephone - order placed via telephone

- Internet - order placed via internet

- Mobile - order placed via mobile application

- AUTO - order generated automatically

Trigger price - price to trigger off the order. When this limit is reached, the order will appear in the order book;

PEG limit - PEG limit for the order determining the maximum/minimum limit price up to which the trading system will modify the order automatically. This is the so-called Ceiling for buy orders or Floor for sell orders;

Quantity shown - quantity of securities that are disclosed in the order book;

Min. quantity - minimum quantity of securities to be traded for the order in the market;

DP - indication whether the order has been placed with the deferred payment option (Yes or No);

CF - indication whether the order has been placed with the Confirm Flag option (Yes or No);

Session date - indication of the session date;

Stock exchange - market of the order

Trades value - value of trades executed for the order;

Commission - amount of commissions charged on trades executed for the order;

Amount deposited - amount of funds deposited for the order.

Settlement currency - currency in which the orders will be executed. This is the currency for the values of Trade value, Commission, Amounts deposited.

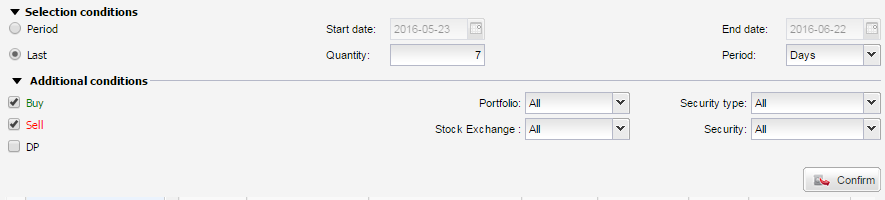

History - selection conditions¶

The History tab by default presents historical orders placed during the last 7 days. In order to apply other filtering criteria, you need to expand the filter section by clicking on the Selection conditions. Apart from changing the time range, you can define additional filtering criteria (available in the filter section) such as:

Side - selection of the order side:

- Buy - show buy orders

- Sell - show sell orders

- DP - show deferred payment orders only. This option cannot be applied in combination with other order side options, so when it is selected other options will be unchecked

Portfolio - selection of the portfolio for which orders have been registered

Security type - selection of the portfolio for which orders have been registered

Stock Exchange - market on which the trade will be concluded

Security - selection of the security for which orders have been registered. The list contains all the securities for which you have ever registered an order, counting from the previous day backwards

Once all the selection criteria are set, you need to press the Confirm button in order to display the section containing the list of orders for the selected period.

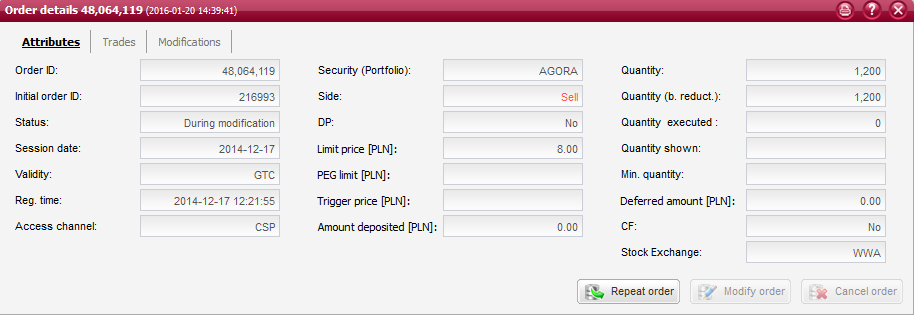

Order details¶

This window provides full details of a selected brokerage order. Such information is divided into three areas presented in separate tabs:

- Attributes - this tab presents all the order attributes

- Trades - this tab presents all trades executed for the order

- Modifications - this tab presents all modifications registered for the order as well as original values of the order (before any modifications)

Regardless of which tab is currently active, the following buttons are available at the bottom of the window:

Attributes¶

This tab presents all the attributes of a brokerage order. Furthermore, if an order is rejected by the stock exchange system, this window will additionally the description of such error.

Order attributes are displayed in the following fields:

Attributes - fields

Order ID - unique ID number of the brokerage order;

Status - status of the order which may have one of the following values:

Inserted

Booked

Sent

On market

Partially executed

During cancellation

During modification

Executed

Closed

Cancelled

Rejected

Note

An order, regardless of its status, may be marked with the following additional symbols:

- - quantity on the order has been reduced (it is not equal to the quantity stated on the initial order)

! - the order has not been served properly by the stock exchange system and this error is described in the WSE error field

Session date - indication of the session date;

Validity - date of the session till the end of which the order shall remain valid or another order validity option. This field may alternatively present the order validity time for GTT (Good Till Time) orders;

Registration time - exact time and date of the brokerage order registration in the system;

Access channel - description of the access channel through which the order has been placed. The following access channels are available: Internet, Mobile, CSP, Phone, AUTO;

Security (Portfolio) - trade name of the security for which the order has been placed. The portfolio number applicable to the order is stated in the brackets (only for derivative market orders);

Side - indication of the Buy or Sell side of the order;

Stock exchange - market of the order;

DP - indication whether the order has been placed with the deferred payment option (Yes or No);

CF - indication whether the order has been placed with the Confirm Flag option (Yes or No);

Limit price - limit price stated on the order;

Trigger price - price to trigger off the order. When this limit is reached, the order will appear in the order book;

PEG limit - PEG limit for the order determining the maximum/minimum limit price up to which the trading system will modify the order automatically. This is the so-called Ceiling for buy orders or Floor for sell orders;

Amount deposited - amount of funds deposited for the order.

Quantity - quantity of securities on the order placed on the market. This quantity may be different from the quantity stated on the initial order if it was subject to a reduction (the field presents the quantity after reduction);

Quantity executed - quantity of securities traded for the order;

Quantity shown - quantity of securities that are disclosed in the order book;

Min. quantity - minimum quantity of securities to be traded for the order in the market;

Deferred amount - initial amount of deferred payment (DP);

WSE error - error description from the trading system, if the order has been rejected

Trades¶

This tab presents the list of all trades executed for a selected order. Below the list, there is a summary including the standard total values as well as the arithmetic average price and the volume weighted average price of the executed trades.

Trades are displayed in the list containing the following columns:

Trades - columns

Number - trade ID number assigned by the stock exchange system (trade note number);

Quantity - quantity of securities traded;

Price - price at which securities were traded;

Value - net value of the trade calculated by multiplying the price by the quantity of securities traded;

Commission - amount of commission charged on the trade;

Execution time - date and time at which the trade was executed;

Settlement date - date of the trade settlement.

Modifications¶

This tab presents the list of all modifications registered for a given order. It also shows the original values of the order, including the order attributes from before any modifications.

In the list of order modifications, bold fonts are used to distinguish any order attributes that have been changed from the previous version of the order that was already on the market (this is also applied to mark any attribute changes between consecutive order modifications provided they were properly placed on the market).

Order modifications are presented in the lists containing the following columns:

Original order values - columns

Quantity - quantity of securities on the original order placed on the market. This quantity might have been different from the quantity stated on the initial order if it was subject to a reduction (the field presents the quantity after reduction);

Quantity shown - quantity of securities that were disclosed in the order book;

Min. quantity - minimum quantity of securities that were to be traded for the order in the market;

Limit price - limit price stated on the order;

Trigger price - price to trigger off the order. When this limit is reached, the order will appear in the order book;

PEG limit - PEG limit for the order determining the maximum/minimum limit price up to which the trading system will modify the order automatically. This is the so-called Ceiling for buy orders or Floor for sell orders;

Quantity (before reduction) - quantity of securities on the initial order (before reduction). This quantity may be different from the quantity that was stated on the order placed on the market, if it was subject to a reduction (the field presents the quantity after reduction);

Session date - indication of the session date;

Validity - date of the session till the end of which the order was to remain valid or another order validity option;

Registration time - exact time and date of the brokerage order registration in the system.

Order modifications - columns

Mod. no. - consecutive number of the order modification. A smaller number indicates that the modification was registered earlier. Number 1 designates the first modification registered for the order;

Status - status of the order modification in accordance with the legend (which is available after moving the mouse cursor over any status designation). An order modification may have one of the following statuses:

WDN - Withdrawn (if a modification has been submitted outside the session time, for an order that has not yet been on the market)

SNT - Sent

SRV - Served

REJ - Rejected

Note

An order modification, regardless of its status, may be marked with the following additional symbols:

- - quantity on the modified order has been reduced (it is not equal to the quantity stated on the order modification instruction)

! - the order modification has not been served properly by the stock exchange system and this error is described in the WSE error field

Quantity - quantity of securities on the modified order placed on the market. This quantity might have been different from the quantity stated on the order modification instruction if the modified order was subject to a reduction (the field presents the quantity after reduction);

Quantity shown - quantity of securities that are disclosed in the order book;

Min. quantity - minimum quantity of securities to be traded for the modified order in the market;

Limit price - limit price stated on the modified order;

Trigger price - price to trigger off the order. When this limit is reached, the modified order will appear in the order book;

Quantity (before reduction) - quantity of securities on the order modification instruction (before reduction). This quantity may be different from the quantity that is stated on the order placed on the market, if it was subject to a reduction (the field presents the quantity after reduction);

Session date - indication of the session date;

Validity - date of the session till the end of which the order shall remain valid or another order validity option. This field may alternatively present the order validity time for GTT (Good Till Time) orders;

Modification registration time - exact time and date of registration of the order modification in the system;

WSE error - error description from the trading system, if the order modification has been rejected.