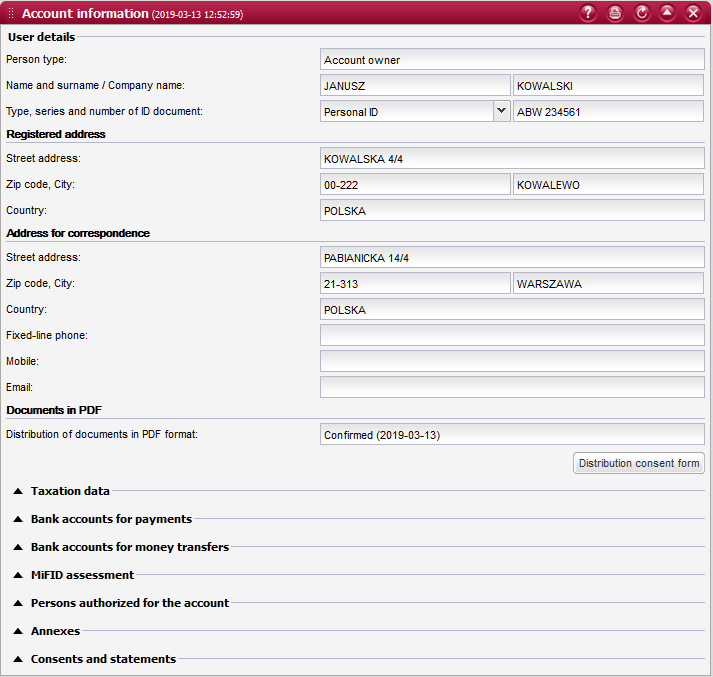

Account information¶

This component provides information about the active brokerage account to which you are currently logged in. It also presents the Client`s personal data.

The component has been divided into several sections, comprising various sets of information. Individual sections contain the following data:

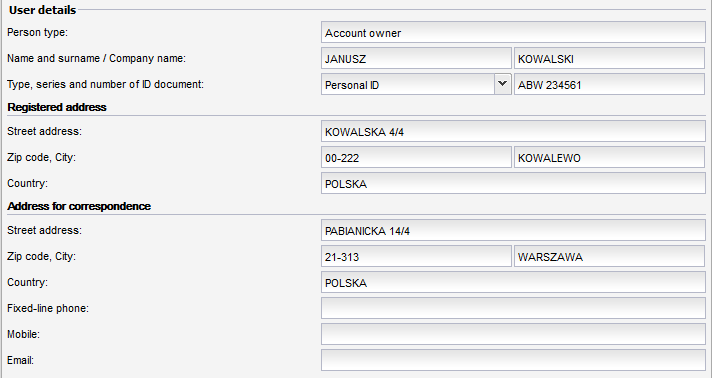

User details

Person type - designation of the account owner, co-owner, plenipotentiary, or person authorized to the Individual Retirement Account (IKE)

Name and surname - first and last name of the Client

Type, series and number of ID document - details of the main identity document

Registered address

Client`s registered address:

Street address - street and house number of the Client`s registered address

Zip code, city - city and postcode of the Client`s registered address

Country - country of the Client`s registered address

Address for correspondence

The Client`s address for correspondence.

In addition, this section includes the contact details that shall be used by the Brokerage House to get in touch with the Client:

Fixed-line phone - registered number of the Client`s fixed-line phone

Mobile - registered number of the Client`s mobile phone

E-mail - registered address of the Client`s electronic mail

Note

In order to change your personal data or contact details, please visit the nearest branch of your Brokerage House

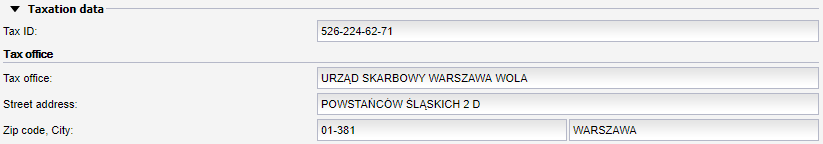

Data for taxation purposes

This section specifies the Client`s tax office and Taxpayer Identification Number registered in the system:

TIN - registered Taxpayer Identification Number of the Client

Tax office - name of the tax office registered for the Client

Street address - street and house number of the tax office registered for the Client

Zip code, city - city and postcode of the tax office registered for the Client

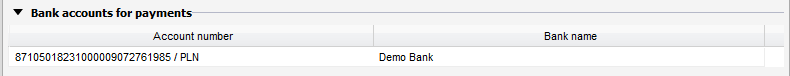

Bank accounts for pay-ins

Bank accounts registered for payments into the brokerage account:

Account number - number of the bank account intended for pay-ins with additional symbol of currency

Bank name - name of the bank account intended for pay-ins

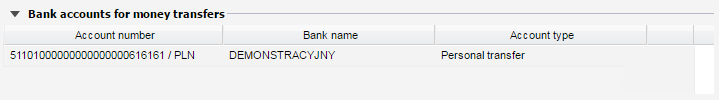

Bank accounts for money transfers

Bank accounts registered for making money transfers from the brokerage account:

Account number - 26-digit number of the bank account for money transfers with additional symbol of currency

Bank name - name of the bank account for money transfers

Account type - type of the bank account

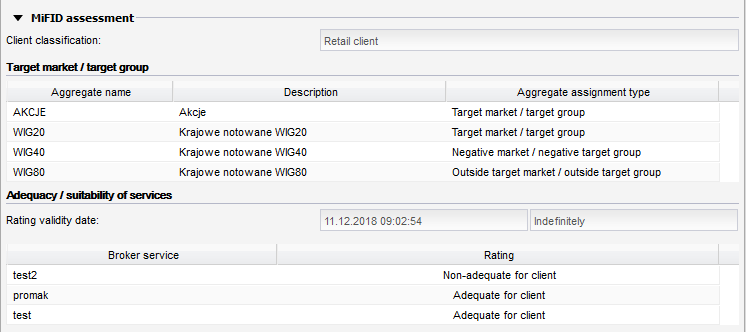

MiFID assessment

Data concerning the Client categorization in accordance with the Markets in Financial Instruments Directive (MiFID)

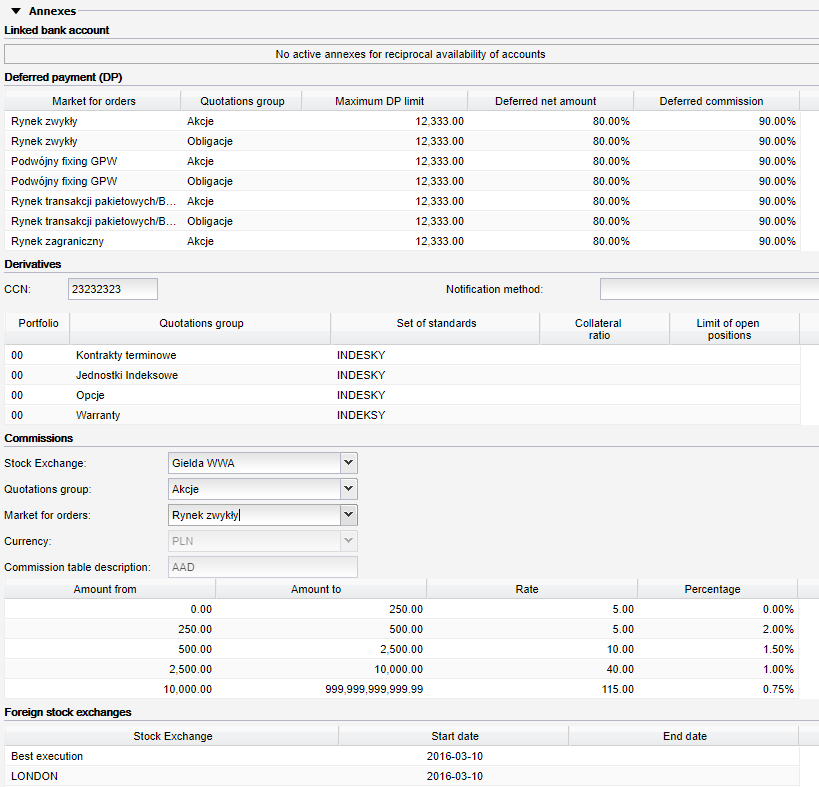

Annexes

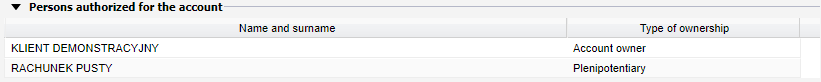

The list of active annexes to the brokerage account agreement. The following annexes can be signed:

Linked bank account (for reciprocal availability of accounts)

If this annex is active, the following bank account details are presented:

Account number - 26-digit number of the linked bank account

Bank name - name of the linked bank account

Deferred payments (DP)

If this annex is active, the system presents a list of deferred payment rights, including the deferred portion of payment for orders and commissions, depending on the market for orders and the group of quotations for securities:

Market for orders - orders market appropriate for the given deferred payment annex

Group of quotations - group of quotations for securities eligible for deferred payments under the given annex

DP limit - maximum amount of payment that can be deferred under the given annex

Deferred net value - percentage of the net value of an order that will be subject to deferred payment if such order is placed with the DP option

Deferred commission - percentage of the commission payable on an order that will be subject to deferred payment if such order is placed with the DP option

Derivative instruments

If this annex is active, the system presents a list of portfolios for which a maintenance margin account is kept, including the following details:

CCN - unique Client Classification Number

Notification method - registered method of sending maintenance margin calls to the Client, applicable to all portfolios

Portfolio - number of the portfolio for which a maintenance margin account is kept

Group of quotations - group of quotations for securities being subject to the annex for derivatives

Set of standards - name of the set of standards for issuances of derivative instruments that can be traded within the given portfolio

Margin ratio - margin ratio for the given portfolio

Limit of open positions - limit of open derivative positions in the given portfolio

Commissions

Comission rates are assigned to certain channel:

Internet - rate of commission for orders placed over the Internet (this is via the Internet system to which you are currently logged in)

Phone - rate of commission for orders placed over the phone (if a relevant agreement has been signed)

CSP - rate of commission for orders placed at the Customer Service Point

Foreign markets

If user has active annexes for foreign markets there is also a list of availabale markets.

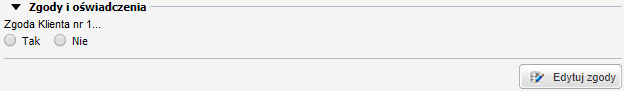

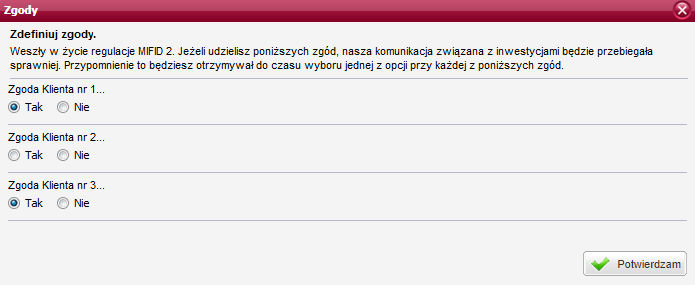

Clicking the Confirm button saves the consent.