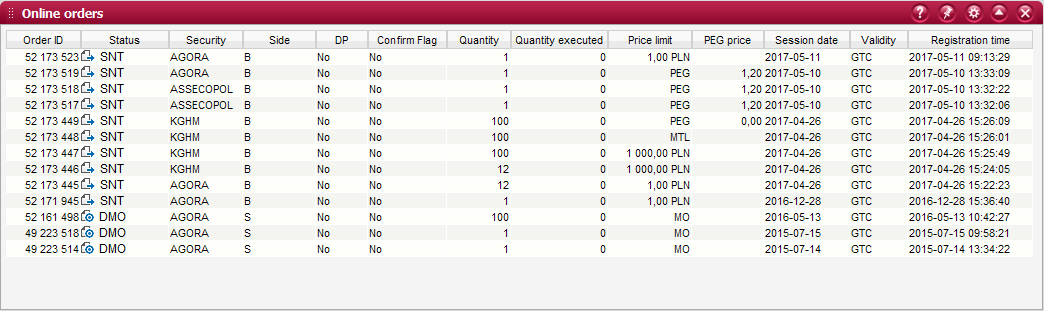

Current online orders¶

The online orders table contains a list of orders that have been registered for the active securities account and are valid on the current date or longer.

The table of orders is presented online and does not require refreshing of its contents - all newly registered orders and any changes in their statuses will be displayed in the table automatically.

Columns of the online orders table

Order ID - unique ID number of the brokerage order in the system;

Initial order ID - ID number of the initial order in the system (an instruction sent to register a brokerage order);

Status - status of the order in accordance with the following legend:

INS - Inserted

BKD - Booked

SNT - Sent

MKT - On market

PEX - Partially executed

DCN - During cancellation

DMO - During modification

EX - Executed

CLD - Closed

CNX - Cancelled

REJ - Rejected

Note

An order, regardless of its status, may be marked with the following additional symbols:

- - quantity on the order has been reduced (it is not equal to the quantity stated on the initial order)

! - the order has not been served properly by the stock exchange system and this error is described in the order details window

Access channel - description of the access channel through which the order has been placed. The following access channels are available: Internet, Mobile, CSP, Phone;

Security (Portfolio) - trade name of the security for which the order has been placed. The portfolio number applicable to the order is stated in the brackets (only for derivative market orders);

Side - indication of the Buy or Sell side of the order;

Quantity - quantity of securities on the order placed on the market. This quantity may be different from the quantity stated on the initial order if it was subject to a reduction (the field presents the quantity after reduction);

Quantity executed - quantity of securities traded for the order;

Price limit - price limit determined for the order;

PEG limit - PEG limit for the order determining the maximum/minimum price limit up to which the trading system will modify the order automatically. This is the so-called Ceiling for buy orders or Floor for sell orders;

Trigger price - price limit to trigger off the order. When this limit is reached, the order will appear in the market`s order book;

Quantity shown - quantity of securities that are disclosed in the order book;

Min. quantity - minimum quantity of securities to be traded for the order in the market;

Session date - indication of the session date;

Validity - date of the session till the end of which the order shall remain valid or another order validity option. This field may alternatively present the order validity time for GTT (Good Till Time) orders;

Registration time - exact time and date of the brokerage order registration in the system;

Trades value - value of trades executed for the order;

Commission - amount of commissions charged on trades executed for the order;

Brokerage orders will be marked with colours by highlighting the whole line in the table. The following colours will be applied:

- fully executed orders - green colour,

- partially executed orders - yellow colour,

- cancelled orders - blue colour,

- orders rejected or invalidated by the Warsaw Stock Exchange - red colour,

- unexecuted orders - white colour.

When you right-click on any order, the orders table context menu will pop up.